This Article has been revised, edited and added to, by Poulomi Chakraborty.

- Why SEO Matters for Financial Advisers

- Understanding SEO Basics

- SEO Best Practices for Financial Advisers

- Understanding the User Intent

- Technical SEO: The Backbone of Your Online Presence

- Optimizing Site Architecture for Enhanced User and Crawler Accessibility

- Implementing Advanced Schema Markup for Richer Search Results

- Prioritizing Page Speed and Core Web Vitals

- Securing Your Site with HTTPS

- Mobile Optimization: Beyond Responsiveness

- Continuous Monitoring and Optimization

- Elevating Your Technical SEO Strategy

- Building Quality Backlinks

- Cultivating Strategic Partnerships for Mutual Growth

- Authority Through Thought Leadership

- Leveraging Digital Platforms for Content Distribution and Engagement

- Hosting and Participating in Financial Webinars and Online Events

- Implementing Advanced Backlink Analysis for Strategic Insights

- Elevating Backlink Building Strategies

- Monitoring and Adapting

- What Experts Say?

- Final Thoughts

In today’s digital age, the landscape of financial advising has drastically evolved. While word-of-mouth and traditional advertising methods still hold value, they are quickly being overshadowed by the vastness and immediacy of online search. Search Engine Optimization, or SEO, has become the modern-day yellow pages for businesses, guiding potential clients right to the doors of financial advisers. For a financial adviser, mastering the realm of SEO can significantly impact visibility, client acquisition, and ultimately, business growth. In this comprehensive guide, we will delve deep into the importance of SEO for financial advisers and provide actionable strategies that can elevate their online presence.

The digital world doesn’t have to be overwhelming. While SEO can seem like a minefield of algorithms and ever-changing tactics, when approached methodically and with expert guidance, it can be an invaluable asset. Let’s embark on this journey together, understanding the nuances and applying best practices specifically curated for financial advisers.

Why SEO Matters for Financial Advisers

- Online Presence: The digital age dictates that if you’re not online, you might as well be invisible. According to statistics, 93% of online experiences begin with a search engine. This implies that a potential client searching for financial advice is likely to start their journey on Google or another major search engine. Being easily discoverable during these searches is crucial for client acquisition.

- Building Credibility: When potential clients search online and find your name or your firm’s name pop up repeatedly, it subconsciously builds credibility. Being on the first page of search results, especially for relevant keywords, paints you as a trusted expert in the field.

- Cost-effective Marketing: SEO is not just effective, but it’s also cost-effective. Unlike paid advertising where you spend every time someone clicks on your ad, SEO focuses on organic traffic. This can lead to a higher Return On Investment (ROI) over time.

Enhancing Digital Trust Through Strategic SEO

Trust is the currency of the financial advising world, and in the digital realm, this trust is often gauged by an adviser’s online presence and accessibility. SEO plays a critical role in building this digital trust.

By ensuring that your expertise is prominently displayed through search engine rankings, you not only increase your visibility but also reinforce your reputation as a leading authority in the financial advising space. Strategic content that addresses the pain points and aspirations of your target audience can further cement this trust, making SEO an indispensable tool in the financial adviser’s arsenal.

SEO as a Client Education Platform

The journey of a prospective client often begins with a quest for knowledge. SEO provides a unique opportunity for financial advisers to meet potential clients at this crucial juncture, offering clarity and guidance on complex financial matters.

By optimizing educational content for search engines, financial advisers can attract clients at the very inception of their financial planning journey. This strategic positioning not only aids in client acquisition but also establishes the adviser as an educational leader, fostering a deeper sense of trust and loyalty among clients.

Navigating the Competitive Landscape with SEO

In a saturated market, standing out is paramount. SEO allows financial advisers to carve out a niche by targeting specific keywords and phrases that align with their unique expertise and services. This level of specificity in SEO strategy can attract a more targeted, and thus more valuable, client base.

Additionally, by analyzing SEO data and trends, financial advisers can gain insights into market demands and client preferences, enabling them to adapt their offerings and strategies in real-time. This adaptive approach not only enhances competitiveness but also ensures that advisers remain relevant and responsive to market changes.

Leveraging Local SEO for Community Engagement

For many financial advisers, the local market represents a significant portion of their client base. Local SEO strategies, such as optimizing for local search terms and engaging with local online communities, can significantly enhance visibility among this key demographic.

Participating in local forums, contributing to local publications, and optimizing Google My Business listings are all strategic SEO actions that can boost local presence. By becoming a visible and active participant in the local digital landscape, financial advisers can foster a sense of community and belonging, further enhancing client trust and loyalty.

The SEO Feedback Loop: A Tool for Continuous Improvement

SEO offers more than just a path to increased visibility; it provides valuable feedback that can inform and refine your marketing and service strategies. Through analytics, financial advisers can track which topics and types of content resonate most with their audience, which keywords are most effective, and how users interact with their site.

This feedback loop is invaluable for continuous improvement, allowing advisers to tailor their content, refine their messaging, and optimize their services to meet the evolving needs of their client base.

SEO as a Strategic Imperative

In the digital age, SEO is more than a marketing tactic; it is a strategic imperative for financial advisers seeking to establish and grow their practice. By leveraging SEO to build trust, educate clients, navigate competition, engage with local communities, and continuously improve based on feedback, financial advisers can secure a competitive edge.

In a profession where trust and credibility are paramount, a well-executed SEO strategy can be the difference between being just another name in the industry and becoming a trusted leader in the field of financial advising.

Understanding SEO Basics

![Keywords: These are the terms and phrases that users type into search engines. It's essential to identify the keywords relevant to your services and area of expertise. For a financial adviser, keywords could range from "best financial adviser in [city name]" to "retirement planning expert."](https://www.winsavvy.com/wp-content/uploads/2024/04/woman-laptop-business-5579998-1024x682.png)

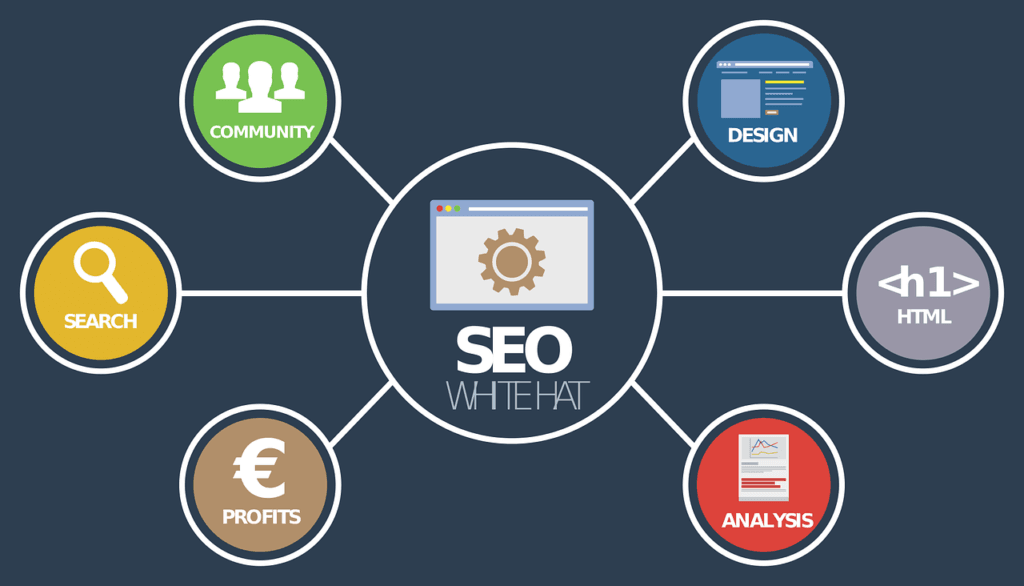

Before we dive into the strategies tailored for financial advisers, it’s essential to understand the core components of SEO.

- Keywords: These are the terms and phrases that users type into search engines. It’s essential to identify the keywords relevant to your services and area of expertise. For a financial adviser, keywords could range from “best financial adviser in [city name]” to “retirement planning expert.”

- On-Page SEO: This refers to the steps taken on your website to improve its ranking. It involves optimizing content, improving page load speed, and ensuring a mobile-friendly design.

- Off-Page SEO: This focuses on external factors affecting your website’s ranking. Backlinks, which are links from other sites to yours, play a vital role here. Quality backlinks can significantly boost your website’s credibility in the eyes of search engines.

Refining Keyword Strategy with Intent and Competitiveness

Keywords serve as the bridge connecting potential clients to your services. However, the real magic lies in the strategic selection and application of these keywords. Beyond basic terms, it’s essential to incorporate long-tail keywords that mirror the specific queries potential clients might use.

Understanding the intent behind search queries—whether informational, transactional, or navigational—can guide the creation of content that meets the user’s needs at the right moment. Additionally, analyzing keyword competitiveness and focusing on niches where you can realistically rank can significantly increase your visibility without directly competing against giants in the industry.

On-Page SEO: Beyond the Basics to User Experience

On-page SEO extends far beyond keyword insertion and meta tags. The ultimate goal is to enhance the user experience, making your website not only findable but also engaging and valuable to your audience. This involves optimizing content for readability with strategic use of headings, bullet points, and short paragraphs. Incorporating multimedia elements like images, videos, and infographics can break up text and make complex financial concepts more accessible.

Moreover, ensuring that call-to-action (CTA) elements are clear and compelling can guide visitors towards becoming clients, transforming your website from a mere information repository into a conversion engine.

Off-Page SEO: Building Authority Through Strategic Partnerships

The essence of off-page SEO for financial advisers lies in establishing authority and trustworthiness in the digital space. Building quality backlinks is a testament to the credibility of your website.

Engage in guest blogging on reputable finance-related platforms, participate in industry forums, and collaborate with non-competing but related businesses to share valuable content. These activities not only improve your site’s SEO but also position you as a thought leader in the financial advising field. Remember, in the world of finance, the quality of your connections often reflects the quality of your advice.

Technical SEO: Ensuring a Seamless Digital Experience

The technical aspects of your website play a crucial role in both user experience and search engine rankings. A fast-loading, mobile-optimized website is no longer a luxury but a necessity, as these factors directly impact user satisfaction and SEO performance.

Regularly auditing your website for issues like broken links, improper redirects, and unoptimized images can prevent potential pitfalls that hurt your rankings. Implementing structured data can also enhance your visibility in search results, making your listings more attractive and informative to potential clients.

Mastering SEO as a Continuous Journey

Understanding and applying the basics of SEO is a continuous journey, not a one-time task. For financial advisers, this journey involves a strategic blend of technical acumen, content excellence, and authority building.

By deepening your understanding of SEO fundamentals and applying these principles thoughtfully, you can create a digital presence that not only attracts the right audience but also builds lasting relationships with clients. As the digital landscape evolves, so too should your SEO strategies, ensuring that your advisory services remain at the forefront of this dynamic industry.

SEO Best Practices for Financial Advisers

- Specialize in Your Niche: While it might be tempting to rank for all financial advisory keywords, it’s essential to hone in on your specialty. If you excel in estate planning or retirement solutions, target those specific keywords. Specializing not only improves SEO but also attracts more qualified leads.

- Quality Content: The mantra ‘Content is King’ holds especially true in the SEO world. Regularly publishing quality, informative content like blogs, videos, or infographics can position you as a thought leader in the field. Besides, it gives search engines fresh content to index.

- Local SEO: As a financial adviser, your primary clientele is likely to be local. Hence, optimizing for local SEO is vital. This includes getting listed in local directories, collecting client reviews, and optimizing for local keywords.

Crafting a User-Centric Content Strategy

A user-centric content strategy goes beyond merely incorporating keywords into blog posts or web pages; it involves creating content that speaks directly to the needs, questions, and pain points of your potential clients. This means diving deep into the financial topics that matter most to your audience, from retirement planning to tax strategies, and presenting this information in a way that is both accessible and actionable.

Video content, infographics, and interactive tools can complement traditional articles and blogs, offering varied ways for users to engage with your expertise. Remember, the goal is to provide value that keeps users coming back and encourages them to take the next step in their financial journey with you.

Enhancing Visibility Through Local SEO Excellence

For many financial advisers, the local market is a primary source of clients. Optimizing for local SEO means more than just claiming your Google My Business listing; it involves a comprehensive strategy that includes collecting and responding to reviews, local backlink building, and local community engagement.

Hosting or participating in local financial planning workshops, webinars, and community events can not only boost your local SEO efforts but also position you as a trusted local authority. Tailoring content to address local financial concerns and highlighting your involvement in local communities can further enhance your visibility and appeal to those seeking financial advice in your area.

Building a Secure, Fast, and Mobile-Friendly Website

In the age of mobile-first indexing and heightened user expectations for speed and security, financial advisers must ensure their websites are built on a solid technical foundation. A secure website (HTTPS) is non-negotiable, offering peace of mind to visitors and a slight ranking boost from Google.

Website speed optimization should be a continual process, leveraging caching, image optimization, and efficient coding practices to keep loading times low. A mobile-friendly design is critical, ensuring that users on any device have a seamless experience. These technical elements not only support SEO efforts but also contribute to a positive user experience that can differentiate your advisory service.

Engaging in Ethical Link-Building Practices

The quality of backlinks to your website significantly impacts your SEO, but the emphasis must be on ethical practices that build real value. Guest posting on reputable finance blogs, participating in industry panels, and contributing to financial news outlets can all generate high-quality backlinks.

Additionally, creating share-worthy content that naturally attracts links—such as original research, comprehensive guides, and insightful commentary on financial trends—can be a powerful strategy. Ethical link-building is a long-term effort that pays dividends in establishing your site’s authority and credibility.

Implementing Advanced Analytics for Continuous Optimization

In the dynamic world of SEO, what worked yesterday might not work tomorrow. Implementing advanced analytics tools and regularly reviewing key performance indicators allows financial advisers to stay ahead of the curve.

Tracking user behavior, conversion rates, and keyword rankings can provide insights into what’s working and what needs adjustment. A/B testing different aspects of your website and content can further refine your SEO strategy, ensuring that your online presence is not only visible but also effective in meeting your business goals.

A Holistic Approach to SEO Success

For financial advisers aiming to excel in the digital landscape, a holistic approach to SEO is essential. This means going beyond basic optimizations to create a comprehensive digital strategy that engages, informs, and converts your target audience.

By focusing on creating user-centric content, excelling in local SEO, maintaining a technically solid website, engaging in ethical link-building, and leveraging analytics for continuous improvement, financial advisers can achieve and sustain a competitive edge in the digital realm.

Understanding the User Intent

In the world of SEO, understanding user intent is crucial. When potential clients search for financial advice or related topics, they usually have a specific need in mind. By aligning your content with these needs, you can attract more targeted traffic.

- Informational Queries: These are searches where the user is looking for information, e.g., “how to plan for retirement” or “benefits of tax-saving investments.” Crafting in-depth articles, eBooks, or webinars on these topics can help cater to this audience.

- Transactional Queries: Searches like “hire a financial adviser near me” or “financial consultancy fees” indicate that the user is close to making a decision. Ensuring your website has clear calls to action and easily accessible contact information can cater to this intent.

- Navigational Queries: If someone searches for your name or your firm’s name directly, they’re likely familiar with your services. Ensure your website provides comprehensive information about what you offer, backed with testimonials or case studies for credibility.

Aligning Content with the Financial Decision-Making Journey

The financial decision-making journey is often complex and multifaceted, requiring a nuanced approach to content creation that addresses each stage of this journey. From initial awareness to consideration, and finally to the decision stage, tailoring your content to match the informational needs of your audience at each phase is crucial.

This involves creating a diverse content portfolio that includes introductory guides for newcomers, detailed analysis for those weighing their options, and compelling case studies or testimonials for individuals ready to make a decision. By mapping content to the decision-making journey, financial advisers can engage users more effectively, moving them seamlessly towards action.

Leveraging Psychographics to Understand Financial Goals and Challenges

Beyond demographics and superficial browsing behavior, diving into the psychographics of your target audience can offer invaluable insights into their financial goals, challenges, and motivations. This deeper understanding enables financial advisers to craft content that speaks directly to the aspirations and pain points of their audience, making it more engaging and impactful.

Conducting surveys, analyzing social media interactions, and monitoring discussion forums can provide a wealth of information that helps tailor your SEO and content strategy to the real needs of your clients.

Advanced Keyword Strategies: Beyond the Surface

Traditional keyword research often focuses on volume and competition, but understanding user intent requires looking beyond these metrics to uncover the why behind the search queries.

This involves analyzing the context of keywords, identifying question-based searches, and using tools that offer insights into the searcher’s intent. By adopting an advanced keyword strategy that prioritizes intent, financial advisers can create content that addresses the specific concerns and questions of their audience, improving engagement and SEO performance.

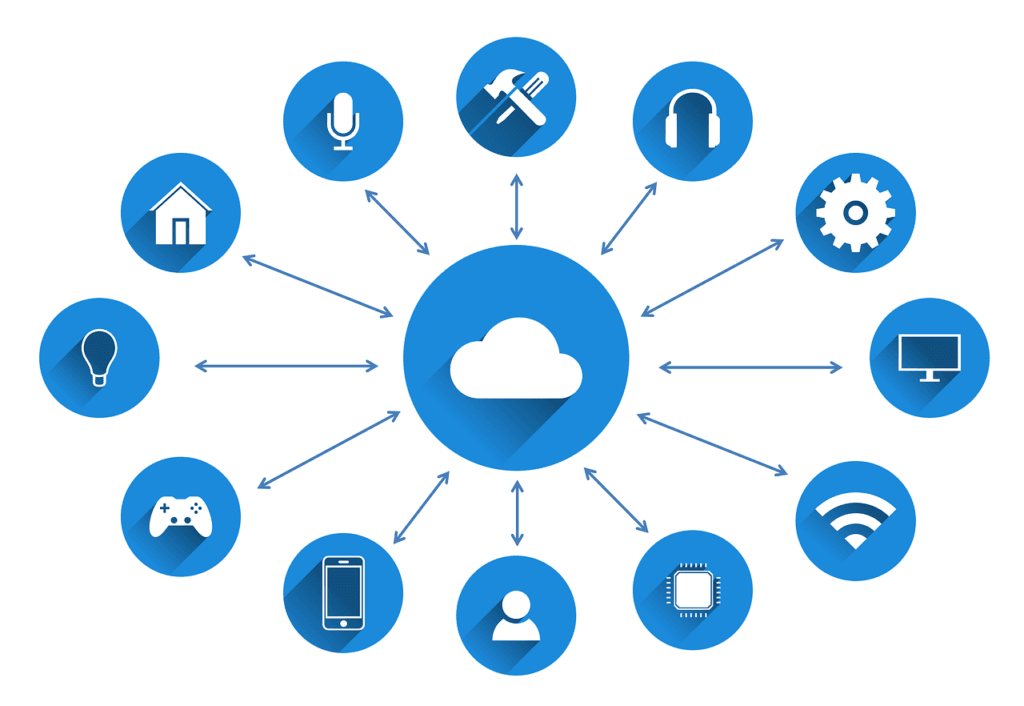

Personalization and User Intent

In today’s digital landscape, personalization is not just a preference; it’s an expectation. Financial advisers can leverage data analytics and AI technologies to personalize the user experience on their websites, offering content recommendations, and solutions based on the user’s browsing history, location, and behavior.

This level of personalization enhances the relevance of your content, making it more likely to engage users and meet their specific needs, thereby aligning closely with their intent.

Predictive Analysis for Anticipating User Needs

Utilizing predictive analysis tools and techniques, financial advisers can anticipate the needs and questions of their target audience, even before they articulate them. This forward-thinking approach involves analyzing trends, user behavior patterns, and market shifts to predict future queries and concerns.

By staying one step ahead, financial advisers can prepare content and resources that address these emerging needs, positioning themselves as proactive and attentive experts in their field.

Mastering User Intent for SEO Excellence

Understanding and aligning with user intent is a dynamic and strategic process that places the user’s needs and journey at the heart of your SEO efforts. For financial advisers, mastering this aspect of SEO means going beyond keywords and rankings to create a digital experience that truly resonates with their audience.

By adopting a holistic approach that includes aligning content with the financial decision-making journey, leveraging psychographics, employing advanced keyword strategies, personalizing the user experience, and utilizing predictive analysis, financial advisers can elevate their SEO strategy, ensuring it is not only visible but also vitally relevant to the clients they seek to serve.

Technical SEO: The Backbone of Your Online Presence

No matter how great your content is, if your website doesn’t function well, it will hinder your SEO efforts.

- Mobile Optimization: With an increasing number of users accessing the internet via mobile devices, ensuring your website is mobile-friendly is crucial. Google, in its ranking criteria, gives preference to mobile-optimized sites.

- Website Speed: A slow-loading website can be a deterrent for potential clients. Tools like Google’s PageSpeed Insights can help analyze and improve your website’s speed.

- Secure and Accessible Website: Search engines prefer sites that are safe and can be easily accessed and crawled. This means having a clear URL structure, a robots.txt file that allows search engines to index your site, and an SSL certificate to ensure your site is secure.

Optimizing Site Architecture for Enhanced User and Crawler Accessibility

A well-structured website is essential for both user navigation and search engine crawling. Financial advisers should focus on creating a logical hierarchy that guides visitors effortlessly to the information they seek, improving user experience and engagement.

Incorporating breadcrumb navigation and a coherent URL structure further aids in this endeavor, making pages easier to find for users and search engines alike. Ensuring that your website’s architecture is optimized for accessibility not only bolsters SEO but also reinforces the user’s confidence in your ability to guide them through complex financial landscapes.

Implementing Advanced Schema Markup for Richer Search Results

Schema markup is a powerful tool that allows search engines to better understand the content of your website and provide richer search results. For financial advisers, utilizing schema markup for articles, FAQs, services, and reviews can dramatically increase visibility in search results, presenting potential clients with a snapshot of your expertise and credibility directly in the SERPs (Search Engine Results Pages). This enhanced visibility can lead to higher click-through rates and an increased perception of authority in your field.

Prioritizing Page Speed and Core Web Vitals

In an age where speed is of the essence, ensuring your website loads quickly across all devices is crucial. Google’s Core Web Vitals offer a set of specific factors that measure the health and usability of a webpage, focusing on load time, interactivity, and visual stability.

By prioritizing these factors and implementing best practices for page speed, such as image optimization, minifying CSS and JavaScript, and leveraging browser caching, financial advisers can significantly improve user experience and SEO rankings.

Securing Your Site with HTTPS

Security is a top concern for clients engaging with financial advisers. Migrating your site to HTTPS, if you haven’t already, is non-negotiable. This not only secures your client’s data but also signals to search engines and users that your site is trustworthy. A secure site can help improve your search engine rankings and reduce the risk of being flagged as unsafe, which can deter potential clients.

Mobile Optimization: Beyond Responsiveness

With mobile searches increasingly outpacing desktop, having a responsive website is just the beginning. Financial advisers should ensure their site offers an optimal mobile experience, which includes fast load times, easy navigation, and accessible content.

Mobile-first design, AMP (Accelerated Mobile Pages), and responsive images are advanced techniques that can enhance the mobile user experience, keeping your site competitive in both mobile search results and user satisfaction.

Continuous Monitoring and Optimization

Technical SEO is not a set-and-forget aspect of your digital strategy. Continuous monitoring through tools like Google Search Console can provide insights into your website’s performance, highlighting issues such as crawl errors, broken links, and security problems that need to be addressed. Regular audits and adjustments in response to evolving SEO practices and website updates ensure your site remains compliant and competitive.

Elevating Your Technical SEO Strategy

For financial advisers, mastering the nuances of technical SEO is crucial for establishing a strong online presence. By focusing on advanced strategies such as optimizing site architecture, implementing schema markup, prioritizing page speed, ensuring site security, optimizing for mobile, and engaging in continuous monitoring, financial advisers can create a website that not only ranks well in search engines but also meets the high standards of trust and professionalism required by their clients. In the competitive world of financial advising, a robust technical SEO foundation is not just an advantage; it’s a necessity.

Related: Check out our free SEO suite

Building Quality Backlinks

Backlinks act as endorsements for your website. When reputable sites link to your content, search engines view this as a vote of confidence, boosting your site’s credibility.

- Guest Posting: Offering to write articles for reputable industry websites or blogs can be an effective way to earn backlinks.

- Networking: Attend industry conferences, webinars, or seminars and build relationships with other experts. Mutual collaborations can lead to quality backlink opportunities.

- Creating Shareable Content: Infographics, case studies, or in-depth research can make your content highly shareable, leading to natural backlinking.

Cultivating Strategic Partnerships for Mutual Growth

One of the most effective ways to build quality backlinks is through cultivating strategic partnerships with reputable organizations and businesses within and adjacent to the financial industry. This could involve collaborating on joint research projects, co-authoring industry reports, or sponsoring financial literacy initiatives.

Such partnerships not only provide valuable content for both parties to share but also open avenues for backlinks that are relevant and authoritative. Additionally, engaging with professional associations and participating in industry panels can amplify your visibility and create natural backlinking opportunities from trusted sources.

Authority Through Thought Leadership

Establishing yourself as a thought leader in the financial advising sector is a powerful strategy for earning quality backlinks. This involves creating insightful, original content that addresses current trends, challenges, and opportunities within the financial sector.

By publishing white papers, detailed guides, and data-driven industry analyses, you can attract attention from industry peers, news outlets, and educational institutions, encouraging them to link back to your work as a valuable resource. Hosting webinars or podcasts featuring guest experts from various financial domains not only diversifies your content but also fosters an environment ripe for reciprocal linking.

Leveraging Digital Platforms for Content Distribution and Engagement

Digital platforms, including social media, forums, and professional networking sites, offer fertile ground for spreading your content and securing backlinks. Actively engaging in online communities related to finance and investing, answering questions with insightful responses, and sharing your content can lead to organic backlink growth. Furthermore, utilizing platforms like LinkedIn to publish articles or Medium to share blog posts can not only increase your reach but also attract backlinks from readers who find your content valuable.

Hosting and Participating in Financial Webinars and Online Events

With the digitalization of networking and professional development, hosting or participating in webinars and online events has become a prime opportunity for backlink building. By offering insightful presentations and valuable resources, you can encourage participants and organizing bodies to link to your site. Collaborating with other financial experts on these platforms can also lead to mutual sharing of content and backlinks, expanding your digital footprint and authority.

Implementing Advanced Backlink Analysis for Strategic Insights

Utilizing advanced tools for backlink analysis allows financial advisers to gain strategic insights into their current backlink profile, identify high-quality backlink opportunities, and monitor the backlink strategies of competitors.

This analytical approach enables the identification of gaps in your backlink strategy and the discovery of new avenues for backlink acquisition. Regularly auditing your backlinks for quality and relevance ensures that your backlink profile remains robust and positively impacts your SEO efforts.

Elevating Backlink Building Strategies

For financial advisers seeking to enhance their online presence, adopting a multifaceted approach to building quality backlinks is essential. By focusing on cultivating strategic partnerships, establishing thought leadership, leveraging digital platforms for content distribution, participating in online events, and implementing advanced backlink analysis, financial advisers can create a backlink profile that significantly boosts their website’s authority and credibility. In the competitive landscape of financial advising, a strong backlink strategy is not just beneficial; it’s a critical component of your digital success.

Monitoring and Adapting

The world of SEO is dynamic. With search engines constantly updating their algorithms, it’s essential to stay on top of these changes.

- Use Analytics: Tools like Google Analytics can provide insights into which keywords are driving traffic, user behavior on your site, and more.

- Stay Updated: Join SEO forums or follow SEO experts on social media to be informed about the latest trends and updates.

- Seek Expert Advice: While understanding the basics of SEO is beneficial, working with an SEO expert or agency can provide deeper insights and strategies tailored to your business.

Establishing a Dynamic SEO Dashboard

Creating a dynamic SEO dashboard using tools such as Google Analytics, SEMrush, or Ahrefs provides a comprehensive view of your website’s performance metrics in real-time. This dashboard should track a wide array of indicators including organic traffic, keyword rankings, bounce rates, and conversion rates.

By consolidating these metrics in one place, financial advisers can quickly assess the health of their SEO strategy and identify areas requiring immediate attention or adjustment. Custom alerts can also be set up to notify you of significant changes, ensuring that you can respond swiftly to any shifts in your website’s SEO performance.

Leveraging AI and Machine Learning for Predictive Insights

The integration of AI and machine learning technologies into SEO strategies offers financial advisers unprecedented capabilities in predictive analytics. These tools can analyze vast amounts of data to forecast trends, anticipate market changes, and predict user behavior.

By harnessing these insights, financial advisers can refine their content strategy, optimize for upcoming keyword trends, and adjust their SEO tactics before changes become industry-wide challenges. This forward-looking approach ensures that your SEO strategy remains not just reactive but predictive, keeping you one step ahead of the competition.

Engaging in Continuous Competitive Analysis

In the competitive arena of financial advising, understanding your competitors’ SEO strategies is as crucial as mastering your own. Regularly conducting a competitive analysis allows you to benchmark your website’s performance against industry leaders, uncover their most effective keywords, and learn from their backlink profiles.

This continuous competitive analysis can reveal new opportunities for optimization and highlight emerging trends in the financial advisory sector, providing insights that can be leveraged to refine and enhance your SEO strategy.

Fostering a Culture of SEO Experimentation

Innovation is key to staying relevant in the SEO landscape. Financial advisers should foster a culture of experimentation within their teams, encouraging the testing of new SEO tactics, content formats, and digital marketing tools.

Whether it’s trialing new schema markups, experimenting with video content, or exploring emerging SEO technologies, these experiments can uncover valuable insights and opportunities. Regularly reviewing the outcomes of these initiatives, and scaling successful experiments, ensures that your SEO strategy evolves in alignment with digital marketing best practices and industry advancements.

Implementing an Agile SEO Methodology

Adopting an agile methodology for your SEO strategy facilitates rapid response to changes in search engine algorithms, consumer behavior, and industry standards. This approach involves setting short-term goals, implementing iterative cycles of testing and learning, and remaining flexible in strategy execution.

By being agile, financial advisers can quickly capitalize on new opportunities, mitigate risks associated with SEO volatility, and continuously improve their online visibility and engagement.

Mastering the Art of SEO Evolution

For financial advisers, mastering the art of SEO is not a one-time achievement but an ongoing journey of monitoring, adapting, and innovating. By establishing a dynamic SEO dashboard, leveraging AI for predictive insights, engaging in continuous competitive analysis, fostering experimentation, and implementing an agile SEO methodology, financial advisers can navigate the complexities of the digital landscape with confidence. In doing so, they not only safeguard their online presence against the vicissitudes of digital marketing trends but also position themselves as leaders in the competitive field of financial advising.

What Experts Say?

I lead a team of 23 specialists, providing top-notch content solutions and link-building services to a diverse clientele, including SEO agencies, online businesses, publishers, and Fortune 500 companies. Here’s my take on your query: Financial services and banking is an industry where trustworthiness and credibility are paramount. Therefore, our SEO tactics are focused on building and reinforcing these attributes.

1. E.A.T. principle: This stands for Expertise, Authority, and Trustworthiness. Google prioritizes these attributes in its search algorithm, especially for finance and health (YMYL – your money your life) websites. We focus on creating high-quality content written by experts, building high-authority backlinks, and maintaining a clean, secure website to enhance trust.

2. Semantic SEO: We use this to better understand and answer the questions users are asking. We optimize for long-tail keywords and use structured data to help Google understand and rank our content.

3. Local SEO: Financial services and banking are often geographically targeted. We leverage local SEO by optimizing Google My Business listings, using local keywords, and earning local backlinks.

4. Mobile-first indexing: As Google now predominantly uses the mobile version of a website for indexing and ranking, we ensure our site is mobile-friendly and fast.

A recent experiment that has worked great for us is the application of AI and machine learning for SEO. We used AI to analyze large sets of SEO data to identify patterns and insights that would have been hard to spot otherwise. This helped us fine-tune our keyword strategy and develop more targeted and effective content.

Israel Gaudette, CEO of Flawless SEO

A fintech leader, Janover Ventures, set out to make the commercial real estate lending processes easier by digitizing lender-borrower engagements and needed to build a strong online presence to reach its target audience. To accomplish this goal, Janover needed short, memorable, and secure domain names that explicitly state what they’re offering and can rank well in search engine results (SEO). They chose Janover.ventures as their corporate domain name and a number of easy-to-understand names for other properties such as multifamily.loans, and commercialrealestate.loans. This strategy of using new web addresses resulted in top SEO rankings and dramatically increased revenue. Borrowers searching the internet for financing options can immediately understand what Janover Ventures does and what services it offers. The organic traffic is also primarily within Janover’s target audience made up of commercial, multifamily and small business borrowers and commercial lenders. Janover’s straightforward, targeted approach also has appeal among investors, helping Janover attract 2,500 retail investors in its first round. Smart digital strategy lead to: 184% growth during the pandemic, with more than $180 million in commercial property and business loan closings More than $2 billion in loan inquiries per month on Janover’s intelligent portal More than $1 million new visitors to its websites in 2020, primarily from organic traffic driven by SEO

Sacha Arts, Bella Vista Communications

In the professional cleaning industry, SEO tactics are instrumental in reaching potential customers seeking cleaning services. At Germicidal Maids House Cleaning Service, we deploy various strategies: Local SEO Dominance: As a local business, ranking well in local search results is paramount. We optimize our Google My Business listing with accurate information, respond to customer reviews, and maintain a strong local online presence. Content Marketing: We regularly produce valuable content related to cleaning tips, home organization, and health and safety. This not only engages our audience but also boosts our website’s authority and search rankings. Technical SEO: We ensure our website is technically sound, focusing on factors like site speed, mobile optimization, and secure browsing (HTTPS). This enhances the user experience and positively affects SEO. Link Building: Building high-quality backlinks is an ongoing effort. We seek partnerships and guest posting opportunities within the home services and nonprofit sectors to strengthen our online presence. Keyword Optimization: Extensive keyword research guides our content strategy. By optimizing our website and blog posts with relevant keywords, we improve our visibility in search engine results. While there’s no one-size-fits-all industry hack, we recently conducted an experiment involving FAQ schema markup. By implementing structured data for frequently asked questions on our service pages, we noticed an increase in the visibility of our FAQs in search results. This led to more organic click-throughs and a boost in overall SEO performance, helping potential customers find the information they need more easily.

Michael Gottron, owner of Germicidal Maids

Final Thoughts

Financial advising is a field that thrives on expertise, trust, and credibility. SEO acts as the bridge connecting financial experts to those seeking guidance. In this ever-evolving digital landscape, understanding and adapting to SEO trends can be the difference between being a recognized industry leader and getting lost in the vastness of the internet. As with financial planning, consistency, patience, and a strategic approach to SEO can yield dividends in the long run.

Read more:

- Management Of Working Capital By Business Owners: 11 Unique Industries!

- Get Your Mortgage Business to the Top of Google: A Step-by-Step SEO Guide

- The Ultimate Guide to Capturing Credit Card Shoppers Through SEO

- How Financial Institutions Can Skyrocket Their Online Presence with SEO

- Unlock the Secrets to Sky-High Rankings for Your Banking Website