Deciding to dissolve a company is as significant as deciding to start one. Whether driven by necessity or strategic choice, the process of dissolving a company in the UK involves several detailed steps that need to be carefully followed to ensure compliance with legal requirements and to protect your financial interests. This guide will walk you through each step, helping you understand and navigate the complexities of winding up your company smoothly and efficiently.

- Understanding the Basics of Company Dissolution in the UK

- Detailed Steps for Dissolving a Limited Company in the UK

- Navigating Potential Pitfalls in the Dissolution Process

- Conclusion

Understanding the Basics of Company Dissolution in the UK

Dissolving a company, often referred to as “striking off” or “winding up,” is akin to erasing it from the records of Companies House, the UK’s registrar of companies. However, unlike deleting a file from your computer with a simple click, the process of legally dissolving a company involves meticulous planning, thorough execution, and adherence to a series of legal procedures.

Comparison with Dissolving a Partnership

To illustrate the dissolution process clearly, let’s compare dissolving a limited company with dissolving a partnership, which is a simpler business structure.

Legal Formalities: Dissolving a limited company is more complex due to its status as a separate legal entity. It requires formal notification to Companies House, settling any outstanding debts, distributing remaining assets, and ensuring all company affairs are comprehensively concluded. In contrast, dissolving a partnership typically involves less stringent legal formalities.

Partners can agree to dissolve a partnership if no formal partnership agreement states otherwise, and the steps mainly involve settling debts and dividing assets among partners.

Creditors and Liabilities: For a limited company, protecting directors and shareholders from personal liability is crucial during the dissolution process. The company must ensure that all creditors are paid or adequately notified before dissolution to avoid legal repercussions that could impact the directors personally after the company is dissolved.

In a partnership, partners are personally liable for any debts or obligations not settled before dissolution, which can lead to significant personal financial risk.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Notification Requirements: The process of dissolving a limited company includes the requirement to formally advertise the intent to dissolve. This advertisement allows creditors, suppliers, and other interested parties to make any claims against the company before it is officially dissolved. There is no equivalent requirement for partnerships unless stipulated by a formal partnership agreement.

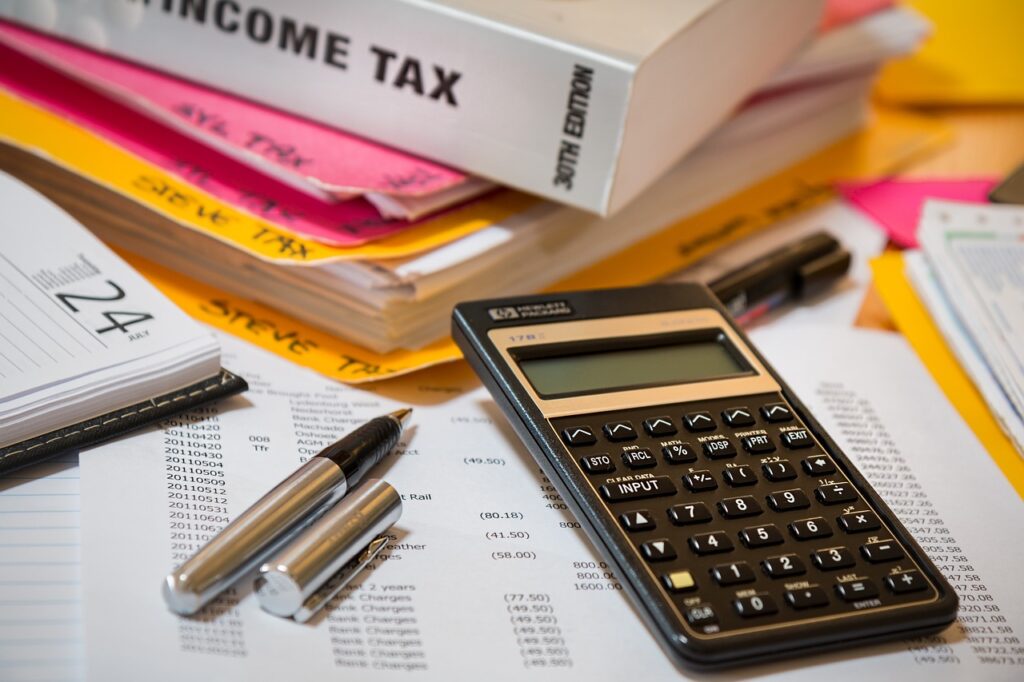

Tax Implications: Both company structures must settle their tax affairs before dissolution. However, for a limited company, the process involves more detailed scrutiny by HM Revenue and Customs (HMRC), especially if the company has been trading.

Any outstanding corporate taxes, VAT, or payroll taxes must be fully paid, and final tax returns submitted. For partnerships, each partner must address their tax responsibilities on their personal returns.

Detailed Steps for Dissolving a Limited Company in the UK

Dissolving a limited company in the UK involves a series of steps designed to ensure that the process is conducted legally and transparently, minimizing any potential financial liabilities for directors and shareholders. Let’s break down these steps, highlighting the essential actions required at each stage.

Decision and Initial Preparations

Deciding to dissolve a company is a significant move that demands careful consideration and meticulous planning. This initial step sets the tone for the entire dissolution process and ensures that all subsequent actions are conducted smoothly and in compliance with legal requirements.

Making the Decision

The decision to dissolve a company should be based on a thorough analysis of the business’s financial health, market conditions, and long-term prospects. This is not a decision to be taken lightly or without consultation with key stakeholders including co-founders, investors, and financial advisors.

Consultation: Engage in discussions with your business partners and advisors to weigh the pros and cons of dissolution versus other potential options like selling the business, restructuring, or seeking additional financing. This collaborative approach ensures all perspectives are considered and supports a well-informed decision.

Strategic Review: Perform a strategic review of your company’s current market position, financial obligations, and potential growth trajectories. This review should include an assessment of all liabilities and assets, an analysis of market trends affecting your business, and projections of future profitability.

Board Resolution

Once the decision to dissolve has been made, it must be formalized through a board resolution. This legal document will outline the reasons for dissolution and the intended steps to wind down the company’s operations.

Legal Formalities: Ensure that the resolution to dissolve complies with your company’s Articles of Association as well as applicable laws. It’s important that this resolution is documented in writing and includes signatures from the majority of the board members.

Record Keeping: Keep a detailed record of the board meeting where the dissolution was decided. This should include minutes of the meeting that detail the discussion points and the final decision. These records are important not just for legal compliance but also for transparency with shareholders and other stakeholders.

Notifying Stakeholders

After the board resolution, the next step is to notify all stakeholders of the decision to dissolve. This includes employees, creditors, customers, suppliers, and investors. Effective communication is crucial to manage expectations and to begin the process of settling debts and obligations.

Employees: Notify your employees as soon as possible about your decision to dissolve. Provide information about what they can expect regarding final paychecks, benefits, and assistance with finding new employment. Transparency and sensitivity in handling this communication are crucial for maintaining goodwill and potentially assisting employees through the transition.

Creditors and Suppliers: Inform creditors and suppliers of your plans and discuss how outstanding obligations will be handled. This might involve negotiating settlements or establishing payment plans. Prompt and open communication can help preserve professional relationships and prevent legal complications.

Customers and Investors: Reach out to customers and investors to explain the situation and how it will be handled. For customers, provide details about how their outstanding orders and services will be fulfilled. For investors, outline the process for any return of capital or final financial reports.

Prepare and Submit the Application to Companies House

After the initial decision-making and stakeholder notifications are handled, the next critical step in dissolving a company involves preparing and submitting the formal application to Companies House. This process is essential for legally ending the company’s existence and requires careful attention to detail to ensure compliance and accuracy.

Preparing the Necessary Documentation

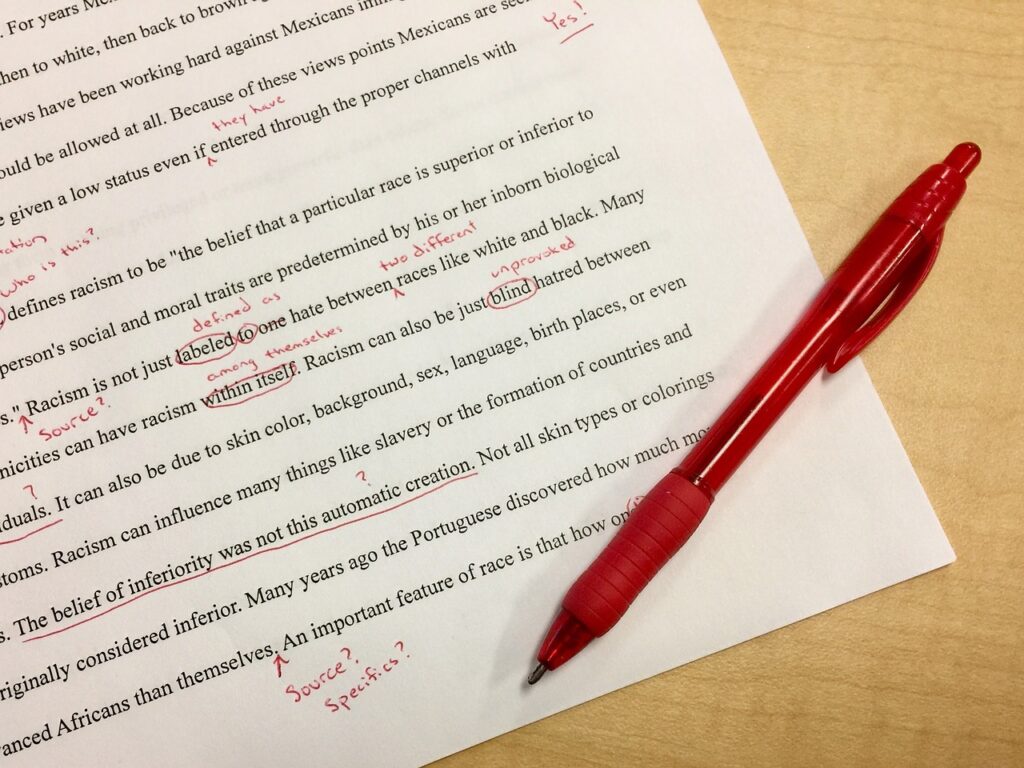

The preparation of the documentation is the first and perhaps most crucial step in submitting your application to Companies House. The primary document required for dissolving a company is Form DS01, the application for striking off a company from the register.

Accuracy of Information: When filling out Form DS01, it is imperative that all information is accurate and up-to-date. This form will require details such as the company name, registration number, and the names and addresses of the directors. Any errors in this form can delay the process or lead to rejection of the application, so double-check all entries against your official company records.

Director Signatures: The form must be signed by the majority of the company’s directors. In the case of a single director, it only requires that one signature, but for multiple directors, ensure you adhere to the specific requirements about how many need to sign, which is usually all or a majority.

Submission Process

Once Form DS01 is filled out correctly and signed, the next step is to submit it to Companies House. This can be done either electronically or via post, depending on your preference or the facilities available to you.

Electronic Submission: Submitting your form electronically is often faster and can be tracked more easily. Companies House provides an online service that facilitates the submission and offers confirmation once the form is received. This method reduces the risk of postal delays or documents getting lost.

Postal Submission: If submitting by post, it’s advisable to use a service that confirms delivery, such as recorded delivery. This ensures that you have proof of your submission, which can be useful if there are any queries or issues with the processing of your form.

Post-Submission Considerations

After submitting the application to dissolve your company, it is crucial to stay informed about the status of your submission and be ready to respond to any inquiries from Companies House.

Monitoring Status: You can check the status of your application through the Companies House website if submitted online. Keeping an eye on the progress of your dissolution request helps you manage any necessary follow-up actions promptly.

Handling Inquiries: Companies House may contact you for further information or clarification regarding your submission. Responding promptly and accurately to these inquiries is vital to keep the dissolution process on track.

Official Gazette Notification: Once Companies House accepts your application, they will post a notice of the proposed striking off in the Gazette, which serves as a formal announcement of your intent to dissolve the company. Monitor this publication for your notice, as it triggers the start of a two-month waiting period during which objections to the dissolution can be raised.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Public Notice and Waiting Period

Once the application to dissolve a company is accepted by Companies House, it enters a crucial phase known as the Public Notice and Waiting Period. This stage is designed to ensure transparency and provide a final opportunity for creditors, suppliers, or any other interested parties to settle outstanding claims or raise objections to the dissolution. Navigating this period effectively is essential to ensure a smooth dissolution process.

Publication in the Gazette

The first step in this phase is the publication of a notice in The Gazette, the UK’s official public record. This notice serves as a formal announcement of your intention to dissolve the company and starts the countdown for the waiting period.

Monitoring the Publication: It’s important to monitor The Gazette for the publication of your notice. Once published, the company’s details and the intent to dissolve will be publicly available, marking the beginning of a two-month waiting period. Keeping track of this publication date is crucial as it officially starts the timeline during which objections can be raised.

Managing the Waiting Period

The waiting period is a statutory duration designed to allow creditors and other parties a chance to claim any outstanding debts or raise objections to the dissolution. Managing this period effectively involves several key actions:

Responding to Inquiries: During this time, it is possible that creditors or other stakeholders will contact the company to settle outstanding debts or disputes. Prompt and clear communication during this period is crucial. Ensure that all inquiries and claims are addressed promptly and documented meticulously to avoid any legal complications later on.

Settling Claims: If claims are made, it’s important to settle them as efficiently as possible. This might involve paying off debts or negotiating settlements. Legal advice can be invaluable in managing these negotiations, ensuring that settlements are legally sound and that they protect the company’s and directors’ interests.

Legal Precautions: If serious objections are raised or if there are signs of potential legal action against the company, it’s crucial to seek legal counsel immediately. A lawyer can provide guidance on how to proceed, whether that means contesting the claims, seeking an alternative resolution, or even halting the dissolution process to address the issues.

Preparing for Possible Delays

It’s important to prepare for possible delays during this period. Objections or unresolved claims can extend the dissolution process beyond the initial two-month waiting period.

Contingency Planning: Develop a contingency plan in case the dissolution process is delayed. This might involve setting aside additional funds to cover ongoing legal or administrative costs, or preparing to maintain minimal operations longer than initially planned.

Communication Strategy: Maintain open lines of communication with all stakeholders throughout the waiting period. Regular updates, even if to report no changes, can help manage expectations and maintain trust. This is particularly important with employees and key customers who might be impacted by the company’s dissolution.

Dissolution and Aftercare

The final phase in the dissolution of a company involves not only the official striking off from the Companies House register but also the essential aftercare that follows. This stage ensures that all residual affairs of the company are wrapped up neatly and that any lingering obligations are fulfilled, allowing for a clean closure.

Official Striking Off

Once the Public Notice and Waiting Period conclude without objections, or once all disputes are resolved, Companies House will proceed to formally dissolve the company. This action removes the company’s legal existence and marks the end of its ability to trade or conduct business.

Confirmation from Companies House: You will receive official notification from Companies House confirming the dissolution. This document is crucial as it serves as proof that the company no longer exists; it is advisable to keep this confirmation in your records for future reference.

Public Record Update: The status of your company will be updated in the public register to reflect its dissolution. Monitoring this update ensures that the information is correctly processed and recorded, providing public confirmation that your company has been legally dissolved.

Managing Aftercare

The dissolution of a company doesn’t necessarily end all responsibilities associated with it. Managing aftercare involves tying up any loose ends and ensuring compliance with record-keeping requirements.

Record Retention: Even after dissolution, certain company records must be retained for a specific period, typically for seven years. This includes financial records, tax returns, and transaction documents. These records are important for legal and tax purposes, especially if questions arise from HM Revenue and Customs (HMRC) or if there are late-discovered claims against the company.

Ongoing Legal Obligations: If there were any legal settlements made as part of the dissolution process, ensure that the terms of these settlements are fully adhered to. This could involve ongoing payments or other obligations that survive the dissolution of the company.

Final Tax Affairs: Completing final tax affairs is an essential part of aftercare. Ensure that all final tax returns are submitted, covering up to the date of dissolution. This includes settling any outstanding tax liabilities. Getting confirmation from HMRC that all tax issues are closed prevents future complications or legal challenges.

Communicating Closure

Proper communication about the dissolution should be maintained throughout the process and even after the company is formally dissolved.

Informing Stakeholders: It’s important to inform all stakeholders, including former employees, customers, suppliers, and creditors, about the dissolution. This communication should reassure them that all legal and financial obligations have been met and provide details on how any outstanding issues will be handled.

Updating Online Presence: If the company had a significant online presence, it’s important to update or take down the company’s website and social media profiles. Leaving outdated or active business websites and social media profiles can lead to confusion and potential legal liabilities.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Navigating Potential Pitfalls in the Dissolution Process

Dissolving a limited company in the UK, while straightforward on paper, can involve several potential pitfalls that could complicate the process, extend timelines, or expose directors to unforeseen liabilities. Being aware of these risks and how to manage them effectively is crucial to ensuring a smooth dissolution process.

Ensuring Complete Creditor Satisfaction

Ensuring complete creditor satisfaction is a crucial aspect of dissolving a company responsibly and legally in the UK. This step is vital not only to meet legal obligations but also to maintain your business reputation and avoid potential legal repercussions that could arise from unsettled debts. Here’s a detailed exploration of strategies to effectively manage and satisfy creditor claims during the dissolution process.

Comprehensive Debt Audit

Start with a comprehensive audit of all your business’s financial obligations. This involves a detailed review of the company’s books, financial statements, and contracts to identify all creditors, including suppliers, lenders, service providers, and any other entities that may have a financial claim against the company.

Engaging with accountants or financial advisors to conduct this audit can help ensure that no debts are overlooked. These professionals can provide an objective assessment of your financial obligations and help prioritize them based on the terms of each agreement.

Transparent Communication with Creditors

Once all debts have been identified, initiating transparent communication with each creditor is crucial. This involves informing them of your intention to dissolve the company and discussing how their claims will be settled.

Send formal notifications to all creditors, outlining your dissolution plan and how you intend to settle existing debts. This should include a clear timeline and the terms of payment. Such communication should ideally be done in writing, providing a record that can be referred to if disputes arise.

If the company is unable to pay all its debts in full, consider negotiating settlements with creditors. This might involve arranging for partial payments or agreeing on alternative compensation. Legal advice might be necessary to ensure that any settlement agreements are binding and legally sound.

Prioritizing Debts

Not all debts are equal, and some will need to be prioritized over others based on legal requirements and the terms of each creditor agreement.

Secured debts, which are backed by assets, generally take priority over unsecured debts. Ensure that any loans or obligations secured against company property are settled first to avoid the forced sale of these assets by creditors.

Ensure that any outstanding employee wages, pensions, and other benefits are prioritized. Failing to do so not only breaches legal duties but can also lead to significant penalties and damage to your reputation.

Legal Documentation and Proof of Payment

Maintaining meticulous records during the dissolution process is essential. This includes keeping copies of all communications with creditors, signed agreements, proof of debt settlements, and legal correspondence. Every interaction with creditors should be documented. This includes keeping copies of settlement agreements, correspondence that outlines negotiated terms, and receipts or proof of payment.

For complex settlements, obtaining legal clearance or advice can prevent future claims against the dissolved company. This might involve having a lawyer review settlement agreements or draft releases that creditors sign to acknowledge that they accept the settlement as full satisfaction of any debts.

Final Steps and Closure

After all debts have been settled, or satisfactory arrangements have been made and documented, you can proceed with the final steps of dissolution.

Ensure that all company bank accounts are closed only after all financial transactions have been completed and debts settled. This prevents any claims that there are outstanding funds or assets that creditors could target. Settle any remaining tax affairs. This includes submitting a final tax return and ensuring that all tax liabilities are cleared with HM Revenue and Customs (HMRC).

Handling Legal Disputes and Claims

Navigating legal disputes and claims is a critical aspect of dissolving a company in the UK, one that requires careful strategy and proactive management. Effective handling of these issues is essential to prevent them from derailing the dissolution process or causing long-term damage to the reputations of the company’s directors. Here’s how startups can manage legal disputes and claims effectively during the dissolution of a company.

Early Identification and Assessment

The first step in effectively managing legal disputes and claims is to identify potential and existing disputes early. This involves a thorough review of all company contracts, obligations, and previous dispute histories to pinpoint areas where legal claims could arise.

Conduct a comprehensive audit of all contracts and agreements to identify clauses that could potentially lead to disputes, such as penalties for early termination, unfulfilled obligations, or disputes over service quality.

Engaging a legal expert who specializes in corporate dissolution can provide valuable insights into the potential risks associated with existing contracts and legal obligations. These professionals can help interpret complex legal language and provide advice on the best course of action.

Proactive Communication and Negotiation

Once potential disputes are identified, proactive communication is key. Reaching out to parties involved in or likely to initiate disputes can open opportunities for negotiation and amicable settlements before formal legal actions are taken. Reach out to all parties involved in contracts or those who have previously raised concerns that could lead to legal claims. Discuss the company’s situation and explore options for mutual agreement outside of court.

Where disputes exist, consider negotiation strategies that could minimize the impact on the company. This might involve offering settlements, renegotiating contract terms to make them more acceptable, or other concessions that can avoid prolonged legal battles.

Structuring Settlements

If disputes cannot be resolved through negotiation and communication alone, structuring formal settlements is the next step. This involves legally binding agreements that stipulate how disputes will be resolved.

Draft formal settlement agreements that clearly outline the terms agreed upon by both parties. These agreements should be comprehensive, covering all aspects of the settlement to prevent future claims. Have all settlement agreements reviewed by legal counsel to ensure they are legally sound and enforceable. This step is crucial to protect the company and its directors from future legal liabilities.

Utilizing Mediation and Arbitration

In situations where negotiations do not lead to a resolution, mediation or arbitration can be effective alternatives to litigation. These methods are usually faster, less expensive, and less adversarial than going to court.

This is a facilitated negotiation, assisted by a neutral third party who helps both sides come to an agreement. It’s non-binding, meaning the mediator does not have the authority to impose a decision. In contrast to mediation, arbitration involves a neutral third party making decisions regarding the dispute. The decisions are usually binding and can only be appealed under certain circumstances.

Managing Ongoing Litigation

If disputes escalate to litigation, managing these effectively becomes essential. This involves a clear strategy and potentially, representation by solicitors who specialize in corporate law.

Engage a solicitor who can represent the company in court. Choose someone with experience in the specific type of dispute you are facing. Ensure that all documents related to the dispute are well-organized and accessible. Good document management can significantly influence the outcome of legal proceedings. Keep track of all developments related to the litigation and remain actively involved in the strategy decisions.

Alternative Strategies If Dissolution Is Not Feasible

When dissolving your company isn’t feasible or strategic, exploring alternative approaches can provide solutions that support the business’s continuity or transition. Here’s a detailed guide on how to navigate two primary alternatives: selling the business and restructuring.

Selling the Business

Selling your business can be a viable option if you wish to exit but believe the company has potential under new ownership. This process involves several critical steps:

Business Valuation: Begin with a professional valuation to understand the worth of your business. This involves assessing not just tangible assets but also intangible assets like brand value, customer base, and intellectual property. A thorough valuation sets the stage for realistic negotiations with potential buyers.

Preparing for Sale: To make your business more attractive to potential buyers, streamline operations, strengthen key relationships, and ensure all financial records are up to date and transparent. Addressing any outstanding legal issues or disputes is also crucial as these can be red flags for potential buyers.

Market the Business: Marketing your business for sale involves reaching out to potential buyers through business brokers, industry contacts, or even employees who might be interested in taking over the business. Confidentiality is key during this phase to avoid unsettling suppliers, customers, or staff.

Negotiation and Sale Agreement: Once a potential buyer is identified, negotiations on price and terms of sale will follow. This stage requires careful consideration of not just the sale price but also the terms of transition, such as your involvement post-sale to ensure a smooth handover.

Legal Formalities: Finalize the sale with all the necessary legal formalities. This usually involves lawyers and accountants to ensure that contracts are sound and obligations clearly defined. Ensuring legal compliance during the transfer of business ownership is essential to avoid future liabilities.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Restructuring the Business

If internal challenges or market conditions are driving considerations of dissolution, restructuring might provide a way to revive the business. This can take several forms, depending on the underlying issues:

Operational Restructuring: This involves revising operational strategies, such as changing product lines, reducing costs, or optimizing processes. The goal is to improve efficiency and profitability, which might involve tough decisions like reducing the workforce or scaling back operations in unprofitable areas.

Financial Restructuring: If debt is a significant issue, restructuring financial obligations might be necessary. This could involve negotiating with creditors for more favorable terms, consolidating loans, or in some cases, arranging for more capital injection from existing or new investors.

Strategic Pivot: Sometimes, pivoting the business to new markets or product areas can provide new growth opportunities. This requires a thorough market analysis to identify viable options and may involve substantial changes to the business model and marketing strategies.

Management Changes: Bringing new life into the business can sometimes mean bringing in new management. Fresh perspectives can identify previously overlooked opportunities for improvement and growth.

Conclusion

Dissolving a company in the UK is a structured and detailed process that requires careful planning, transparent communication, and meticulous adherence to legal procedures. From making the initial decision and settling all debts to submitting the necessary paperwork and managing the aftercare, each step must be handled with precision to ensure a smooth and compliant closure. By thoroughly understanding and effectively managing each phase of the dissolution process, business owners can ensure that all legal, financial, and corporate responsibilities are met, paving the way for a clear and definitive conclusion to the company’s affairs. This not only protects the interests of all stakeholders involved but also maintains the integrity and reputation of the business leaders as they move forward to new ventures or opportunities.

Read Next:

- The Crucial Difference Between ‘Ltd’ and ‘Limited’ in Company Names in the UK

- Ensuring Legal Compliance: How to Register Your Company in the UK

- A Guide to Ethical Business Practices in Company Formation

- Closing Your Limited Company in the UK: Steps and Considerations

- The Pros and Cons of Different Company Structures in the UK

Comments are closed.