This Article has been revised, edited and added to, by Poulomi Chakraborty.

- Unraveling the Social Signals Paradigm

- The Mechanism of Influence

- Empirical Insights: Social Signals and SEO Metrics

- Social Signals: A Strategic Asset for Financial Services SEO

- The Synergy of Social Media and SEO in Financial Services

- Measuring the Impact

- Tailoring Strategies for Optimal Synergy

- Opinion of Industry Expert

- Conclusion

In the sophisticated world of digital marketing for financial services, SEO and social media are often viewed as distinct entities, each maneuvering its distinct pathway to augment online visibility and user engagement. However, in the nuanced dance of optimizing search engine visibility, social signals emerge as silent yet potent influencers, weaving an intricate tapestry where social media interactions resonate in the enigmatic algorithms of search engines.

The article aims to unfurl this intricate dance, unveiling how social signals intricately impact SEO in the dynamic landscape of financial services. In a sector marked by stringent regulations, customer skepticism, and competitive rivalry, integrating social signals into the SEO narrative isn’t an option but a strategic imperative.

Unraveling the Social Signals Paradigm

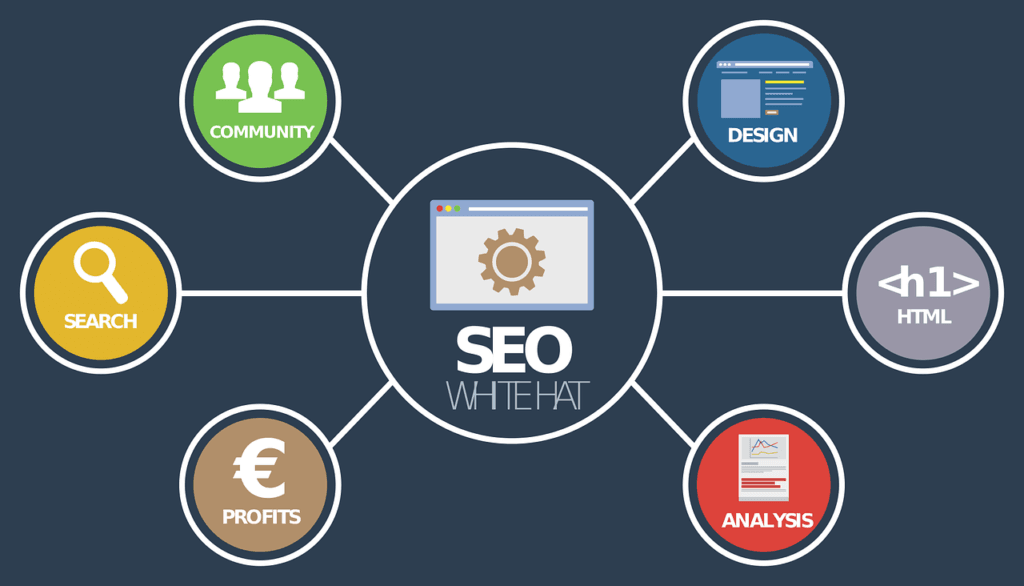

To fathom the depth of this impact, it’s pivotal to first demystify what constitutes social signals. These are indicators emanating from social media interactions – likes, shares, comments, tweets, and even the nuanced engagement metrics. Each interaction, though seemingly inconsequential in isolation, collectively converges into a potent force influencing SEO.

Role of Social Signals in SEO Algorithm

Search engines, in their pursuit to deliver the most relevant, authentic, and valuable content to users, have intricately woven social signals into their algorithms. Each like or share amplifies the content’s reach, visibility, and perceived value.

For financial services, where trust and credibility are not just valued but mandatory, social signals serve as endorsements. They are silent testimonials of content relevance, value, and authenticity.

The Genesis of Social Signals in Financial Narratives

At the heart of social signals lies the concept that every digital interaction, whether a comment on a blog post or a share of a financial advisory video, contributes to the broader narrative of a brand’s online presence. For startups in the financial sector, navigating this landscape requires a blend of creativity, strategy, and foresight.

The initial step towards leveraging social signals is understanding their genesis within your specific financial narrative. This involves crafting content that resonates not just with the immediate needs of your audience but also engages them in a conversation about their financial future. It’s about creating a digital ecosystem where every tweet, post, or comment adds a layer of trust and authority to your brand.

Cultivating a Strategy for Social Signal Integration

Crafting a Compelling Narrative

Developing a compelling narrative is paramount. Your content must not only inform but also inspire your audience to engage, share, and interact. This narrative should be deeply embedded in the knowledge of your target market’s pain points, aspirations, and financial goals. The aim is to transition from mere information dissemination to creating a participatory and interactive platform.

Strategic Content Diversification

Diversifying your content portfolio to include various formats such as videos, infographics, podcasts, and webinars is crucial. This approach caters to different preferences within your target audience, increasing the likelihood of engagement and shares. More importantly, it enables you to present complex financial concepts in accessible and engaging ways, enhancing understanding and trust.

Tailoring Engagement Strategies

Engagement shouldn’t be left to chance. Tailoring your engagement strategy to align with the behavioral patterns and preferences of your target audience is essential. This means analyzing the times they are most active, the types of content that generate the most interaction, and the platforms they frequent. Utilizing this data allows for the optimization of content delivery, maximizing visibility and engagement.

Amplifying Visibility Through Strategic Partnerships

Collaborations with influencers, thought leaders, and other financial institutions can significantly amplify your content’s reach and credibility. These partnerships should be strategic, aiming to co-create content that is mutually beneficial and aligns with the values and objectives of both parties. This collaborative effort not only expands your reach but also introduces your brand to new, but relevant, audiences.

Leveraging Technology for Enhanced Social Signal Analysis

Incorporating technology and tools for analyzing social signals is not an option but a necessity. Advanced analytics tools offer insights into the performance of your content across social platforms, providing valuable data on engagement metrics, audience growth, and content reach. More importantly, they offer actionable insights, allowing for the refinement of strategies in real-time to optimize performance.

Integrating Social Listening

Social listening tools are invaluable in this context. They allow for the monitoring of mentions, keywords, and sentiments associated with your brand across the digital sphere. This real-time data provides a pulse on your brand’s online health and offers opportunities to engage directly with your audience, address concerns, and capitalize on positive sentiment.

The Strategic Imperative of Social Signals

In the digital tapestry of financial services, social signals stand out as both a beacon of opportunity and a strategic imperative. For startups aiming to carve out a niche in the competitive financial sector, understanding and integrating social signals into their SEO and digital marketing strategies is not just beneficial—it’s critical.

The journey of unraveling and leveraging the social signals paradigm is continuous. It requires a commitment to strategic planning, a willingness to innovate, and a dedication to engaging with your audience on a meaningful level. By doing so, financial service startups can not only enhance their SEO performance but also build a resilient and trusted brand in the digital age.

The Mechanism of Influence

How do these seemingly simple social interactions transcend to influence the complex, algorithmic world of SEO for financial institutions?

Content Visibility and Reach

Each share or like on social media amplifies content reach. In the world of financial services, where content often encapsulates critical financial insights, advice, and offerings, enhanced reach translates into increased visibility. Search engines perceive this amplified reach as an indicator of content relevance and value.

User Engagement and Interaction

Social signals are not passive; they are interactive. Each comment or engagement unveils a narrative of user interaction. For search engines striving to offer user-centric content, these interactions are indicative of content quality and relevance.

Enhancing Organic Search Rankings

Social signals serve as a silent testimony to the content’s quality, relevance, and engagement quotient. In the financial services landscape, where content is not just information but a tool for engagement, decision-making, and trust-building, the impact of social signals is profound.

- Quality Backlinks: Social media sharing leads to the generation of quality backlinks. Each share is a link, and when reputable and high-engagement social media profiles share content, it amplifies the content’s credibility and authority. Search engines, deciphering these backlinks, integrate this insight to enhance the content’s organic search ranking.

- Brand Authority: In the realm of financial services, brand authority is pivotal. Social signals augment brand authority. Each interaction, engagement, and share on social media platforms is a narrative that amplifies brand visibility, recognition, and authority. This increased authority resonates with search engine algorithms, leading to enhanced organic search rankings.

The Psychological Impact of Social Signals

Building Social Proof

At the core of the social signals’ influence lies the concept of social proof. In the digital age, every like, share, and comment serves as a testament to your content’s value and relevancy, acting as a digital form of word-of-mouth. For financial startups, leveraging this social proof means not only showcasing these interactions but also actively encouraging them. It’s about creating an environment where your audience doesn’t just consume your content but becomes an advocate for it.

Enhancing Perceived Value Through Engagement

Engagement goes beyond mere metrics; it’s a reflection of your brand’s ability to resonate with its audience. The depth and quality of interactions around your content directly influence its perceived value. Not only does this enhance your brand’s authority in the eyes of search engines, but it also strengthens trust with your audience. For startups, fostering a high-engagement community can be a game-changer, transforming passive observers into active participants in your brand’s narrative.

Strategic Content Amplification

Leveraging User-Generated Content

User-generated content (UGC) is a powerful tool in amplifying your brand’s reach and enhancing its SEO. Encouraging your audience to share their experiences, reviews, or insights not only generates additional content but also enhances your brand’s authenticity. For financial startups, strategies to promote UGC can include hosting forums, encouraging testimonials, or running social media campaigns that invite user participation.

Harnessing the Power of Social Influencers

In the financial sector, where trust is paramount, collaborating with influencers can significantly boost your brand’s visibility and credibility. Choose influencers whose values align with your brand and who possess a genuine influence over their audience. This partnership can lead to the creation of content that not only reaches a wider audience but also carries the weight of trusted endorsement.

Optimizing for Algorithmic Affinity

Creating Content with Algorithmic Appeal

Understanding the intricacies of social media algorithms is crucial for ensuring your content is seen by your target audience. These algorithms prioritize content based on engagement, relevance, and recency. Therefore, producing timely, engaging, and valuable content is key. For financial startups, this means not only staying abreast of financial trends and news but also ensuring your content is designed to engage (e.g., through questions, calls-to-action, and interactive elements).

Embracing Multimedia Content

Multimedia content, such as videos, live streams, and interactive infographics, has been shown to significantly increase engagement rates. For financial services startups, this presents an opportunity to break down complex financial information into digestible, engaging formats. Additionally, these content types are favored by social media algorithms, increasing the chances of your content being promoted across platforms.

Continuous Strategy Evolution

Adapting to Platform Dynamics

The digital landscape is perpetually evolving, with social media platforms constantly updating their algorithms and features. Staying informed and adaptable to these changes is crucial. Regularly review your content strategy and performance analytics to understand what’s working and what isn’t. This adaptability ensures that your startup remains at the forefront of digital marketing innovation within the financial sector.

Engaging in Active Listening and Analytics

Utilizing social listening tools and analytics allows for a deep understanding of how your content is perceived and engaged with online. This insight is invaluable for refining your content strategy, ensuring that it remains aligned with audience interests and platform trends. For startups, this means not just tracking metrics but analyzing them to derive actionable strategies for enhancing visibility and engagement.

Mastering the Art of Digital Influence

For financial services startups, understanding and leveraging the mechanism of influence of social signals on SEO is not just a strategy but a necessity for digital success. It requires a blend of psychological insight, content excellence, and strategic foresight. By deeply engaging with these principles and continuously evolving strategies, startups can navigate the complexities of the digital landscape, turning every social interaction into a step toward greater visibility, trust, and success in the financial sector.

Empirical Insights: Social Signals and SEO Metrics

The confluence of social signals and SEO isn’t theoretical but empirical. Analyzing SEO metrics, one observes a palpable impact when social signals are optimized.

- Traffic and Engagement: Content with high social signals witnesses increased traffic and engagement. In the financial services sector, where engagement often translates into trust, this increased traffic isn’t just a numerical increment but a qualitative enhancement of user trust and credibility.

- Bounce Rate: Content endorsed through social signals often witnesses a lower bounce rate. Users are more engaged, explore further, and interact more – a testament to the content’s quality and relevance.

Leveraging Data for Strategic Decision-Making

The Importance of Deep Analytics

At the heart of understanding the impact of social signals on SEO is the utilization of deep analytics. This involves going beyond surface-level metrics such as likes and shares to explore more nuanced insights like engagement rate, click-through rate (CTR), and the sentiment of interactions. For financial services startups, this deep dive into analytics enables a more strategic allocation of resources, focusing efforts where they are most effective.

Integrating SEO and Social Media Analytics

The symbiosis between SEO and social media performance is undeniable. By integrating analytics from both arenas, startups can gain a comprehensive view of their online presence. This integration involves analyzing how social media engagement impacts website traffic patterns, conversion rates, and even search engine rankings. Employing tools that offer this integrated analysis can uncover correlations that are pivotal for refining SEO strategies in line with social media performance.

The Predictive Power of Social Engagement

Anticipating Trends with Social Signals

Social media is not just a platform for engagement but also a barometer for trends and user interests. By closely monitoring social signals, financial services startups can anticipate shifts in consumer behavior and preferences. This predictive power allows for the agile adaptation of content strategies, ensuring that the offered information remains relevant and engaging.

Crafting Content that Meets Future Needs

Utilizing the predictive insights gained from social signals, startups can craft content that not only addresses current interests but also anticipates future needs. This forward-looking approach ensures that the content remains valuable over time, enhancing its lifespan and effectiveness in SEO strategies. It also positions the startup as a thought leader in the financial services sector, ahead of emerging trends and shifts.

The Role of Sentiment Analysis in Refining Strategies

Understanding Audience Sentiment

Sentiment analysis offers a window into the emotional resonance of your content. By analyzing the sentiment behind social interactions, financial services startups can gauge the effectiveness of their messaging and its alignment with audience expectations. This understanding can drive strategic adjustments in content tone, style, and delivery, enhancing its impact and engagement.

Leveraging Positive Sentiment for SEO Advantage

Positive sentiment, when leveraged correctly, can significantly boost SEO efforts. Encouraging satisfied clients to share their positive experiences on social media not only amplifies social signals but also enhances brand reputation. Moreover, incorporating testimonials and case studies on your website can improve its content quality, further boosting SEO performance.

Continuous Improvement through A/B Testing

The Importance of A/B Testing in Social Strategy

In the dynamic digital landscape, what works today may not necessarily work tomorrow. A/B testing offers a methodical approach to comparing different strategies, content formats, and messaging to determine what resonates best with your audience. For financial services startups, regular A/B testing is essential for continuously refining social media and SEO strategies, ensuring they remain optimized for engagement and search visibility.

Data-Driven Content Optimization

Utilizing the insights gained from A/B testing, startups can optimize their content for both social engagement and SEO. This optimization might involve tweaking headlines, adjusting content formats, or even altering publishing schedules. The key is to base these adjustments on empirical data, ensuring that each decision is aimed at enhancing performance across both social media and search engines.

Empirical Insights as a Beacon for SEO Success

In the competitive realm of financial services, empirical insights into the relationship between social signals and SEO offer a strategic advantage. By adopting a data-driven approach, financial services startups can not only navigate but thrive in the digital landscape. This involves a continuous cycle of analysis, adaptation, and optimization, ensuring that every piece of content and every social interaction contributes to the overarching goal of enhanced SEO performance and, ultimately, business success.

Related: Check out our free SEO suite

Social Signals: A Strategic Asset for Financial Services SEO

For financial institutions navigating the competitive and regulatory landscape, social signals emerge not as optional elements but as strategic assets in their SEO arsenal.

- Trust and Credibility: In a sector where trust is the cornerstone, social signals enhance trust and credibility. Each like, share, and comment is a user endorsement, and in the world of finance, these endorsements translate into increased trust, credibility, and user confidence.

- User-Centric Content: Financial services are evolving to be intensely user-centric. Social signals offer insights into user preferences, needs, and behaviors. This insight is gold, enabling financial institutions to tailor their content to be not just informative but personalized, relevant, and user-centric.

Cultivating a Robust Online Presence

Establishing Trust Through Consistent Engagement

In the financial services sector, where trust is both a commodity and currency, the consistent engagement that fuels social signals is crucial. A robust online presence built through regular interaction with your audience can foster a sense of reliability and authenticity. For startups, this means not just posting content sporadically but maintaining a consistent schedule of engagement that keeps your brand at the forefront of your audience’s mind.

Building a Community Around Your Brand

More than ever, consumers are looking for brands they can relate to and be part of. Creating a community around your brand encourages a deeper connection between your audience and your financial services. This community becomes a fertile ground for generating organic social signals as members share content, participate in discussions, and advocate for your brand. For startups, hosting webinars, live Q&A sessions, and interactive polls can be effective ways to build and nurture this community.

Leveraging Social Insights for Product Development

Utilizing Feedback Loops for Innovation

Social signals provide an immediate and unfiltered feedback loop from your target audience. For financial services startups, this feedback is invaluable for product development and innovation. By analyzing social interactions, startups can identify gaps in the market, uncover pain points, and tailor their offerings to meet the evolving needs of their clients. This proactive approach to product development can significantly enhance a startup’s value proposition and SEO potential.

Enhancing Personalization with Social Data

In the age of data, personalization has become a key differentiator. Social signals offer rich insights into the preferences and behaviors of your audience, allowing for the customization of services and communication. For financial services startups, leveraging this data can mean the difference between a generic offering and one that resonates deeply with potential clients. Tailoring content, recommendations, and services based on social data can significantly improve engagement and, by extension, SEO outcomes.

Strategic Content Syndication

Maximizing Reach Through Selective Syndication

Not all social platforms are created equal, especially in the financial services sector. Strategic content syndication involves choosing the right platforms that align with your target audience’s preferences and behavior. For startups, this might mean focusing efforts on LinkedIn for B2B services or Instagram for consumer-facing products. Selective syndication ensures that your social signals are not just widespread but also targeted, amplifying their impact on SEO.

Collaborating with Fintech Influencers

Influencer marketing has transcended consumer goods to become a powerful tool in financial services. Collaborating with fintech influencers can catapult your brand into the spotlight, generating a surge of social signals. For startups, it’s essential to choose influencers whose audience aligns with your target market and whose values resonate with your brand ethos. This strategic alignment ensures that the social signals generated are not only abundant but also impactful.

Navigating the Future with Social Signals

As financial services startups navigate the complex and competitive digital landscape, the strategic importance of social signals in SEO cannot be overstated. These signals offer a multifaceted tool for building trust, engaging with your audience, and refining your offerings.

By understanding and leveraging social signals, startups can enhance their SEO performance, carving out a niche in the financial services sector. This journey involves a continuous process of engagement, analysis, and adaptation, with social signals guiding the way towards digital success.

The Synergy of Social Media and SEO in Financial Services

This symbiosis between social signals and SEO isn’t spontaneous but necessitates strategic orchestration. For financial services aiming to leverage this synergy, certain imperatives can’t be overlooked.

Creating Shareable Content

- Insightful and Valuable: Content should not just inform but add value. Financial insights, advice, and analyses should be embedded, making the content a source of learning, insights, and empowerment.

- Engaging and Interactive: Engagement is the precursor to social sharing. Content should be interactive, inviting users to engage, comment, and share.

Social Media Optimization

- Active Profiles: Having active, updated, and engaged social media profiles is pivotal. These platforms are the conduits of social signals.

- User Engagement: It’s not just about posting content but engaging users. Responding to comments, initiating discussions, and interactive posts augment user engagement and social signals.

Integrating Social Media Insights into SEO Strategies

Crafting Content with Precision

The first step in leveraging the synergy between social media and SEO is to craft content that is precision-targeted to your audience’s needs and interests. This involves utilizing insights gained from social media interactions, such as popular topics, questions, and feedback, to inform your content strategy. For financial services startups, this means producing content that not only addresses the current financial landscape but also anticipates future trends and customer needs.

Enhancing Keyword Strategy with Social Listening

Social listening can reveal the language and phrases your target audience uses when discussing financial topics online. Integrating these insights into your SEO keyword strategy can significantly enhance your content’s visibility and relevance. For startups, employing a dynamic keyword strategy that evolves with changing market trends and customer conversations is crucial. This approach ensures that your content remains both discoverable and engaging over time.

Strengthening Brand Authority through Social Engagement

Establishing Thought Leadership

In the competitive world of financial services, establishing your brand as a thought leader is essential for gaining trust and credibility. Utilize both social media and SEO to showcase your expertise and insights on financial matters. This could involve publishing in-depth analyses, white papers, and case studies that are then promoted across social platforms. By aligning this content with strategic SEO practices, startups can enhance their visibility and authority simultaneously.

Leveraging User Engagement for SEO Benefit

User engagement on social media, such as comments, shares, and likes, can serve as a signal to search engines about the relevance and value of your content. Encouraging active participation and engagement on social platforms can thus indirectly benefit your SEO efforts. For financial services startups, fostering a community where users are encouraged to interact with content can lead to higher search rankings and increased online visibility.

Creating a Unified Digital Presence

Coordinating Content Releases

Synchronizing content releases across social media and SEO channels can amplify the impact of your marketing efforts. This involves planning your content calendar to ensure that major pieces of content, such as research reports or product announcements, are supported by social media campaigns that drive traffic to your website. For startups, this coordinated approach maximizes the reach and engagement of each content piece, leveraging the strengths of both channels.

Monitoring and Adapting to Performance Metrics

The synergy between social media and SEO is not static; it requires continuous monitoring and adaptation. Utilizing analytics tools to track the performance of your content across both channels can provide valuable insights into what strategies are working and what needs adjustment. For financial services startups, regularly reviewing metrics such as traffic sources, engagement rates, and conversion from social media to website visits is essential for refining and optimizing your digital marketing strategy.

Achieving Strategic Empowerment through Synergy

For financial services startups, the synergy between social media and SEO is not merely a tactical advantage but a strategic imperative. By integrating social media insights into SEO strategies, strengthening brand authority through social engagement, creating a unified digital presence, and continuously monitoring performance, startups can navigate the complexities of the digital landscape with confidence. This integrated approach not only enhances online visibility and user engagement but also positions financial services startups for sustainable growth and success in a competitive market.

Measuring the Impact

Every strategic initiative in SEO is incomplete without a comprehensive mechanism to measure impact. In the integration of social signals, this measurement is not just quantitative but qualitatively insightful.

Tools and Analytics

- Social Media Analytics: Platforms like Facebook and Twitter offer detailed analytics. These insights, beyond likes and shares, offer a deep dive into user engagement, content reach, and interaction patterns.

- SEO Analytics: Tools like Google Analytics should be configured to capture the impact of social signals on SEO metrics. Monitoring organic traffic, bounce rate, and engagement metrics offers insights into the tangible impact of social signals.

Key Performance Indicators (KPIs)

Financial institutions should identify and monitor KPIs that resonate with their SEO and social media objectives.

- Engagement Metrics: These KPIs, including likes, shares, comments, and retweets, offer direct insights into the intensity and quality of social signals.

- SEO Metrics: Organic traffic, bounce rate, average session duration, and conversion rate are critical KPIs unveiling the impact of social signals on SEO performance.

Advanced Analytics for Comprehensive Insight

Implementing Cross-Channel Analytics

To truly understand the impact of social signals on SEO, startups must employ cross-channel analytics that can track user journeys from social media interactions to website engagement and conversion. This involves integrating analytics platforms like Google Analytics with social media analytics tools to create a holistic view of how social engagements contribute to SEO performance. For financial services startups, this means going beyond surface-level metrics to analyze the pathways through which social interactions lead to meaningful engagements on their platforms.

Leveraging Predictive Analytics

Predictive analytics can provide startups with foresight into the potential future impact of their current social media and SEO strategies. By analyzing historical data and current trends, predictive models can forecast future traffic, engagement, and conversion rates. This forward-looking approach allows financial services startups to adjust their strategies proactively, staying ahead of market trends and competitor moves.

Segmenting Data for Strategic Insights

Audience Segmentation

Diving deeper into analytics involves segmenting your data to understand the behaviors and preferences of different audience segments. This segmentation can reveal how various groups interact with your content and through which social channels they are most engaged. For financial services startups, understanding these nuances can tailor content and communication strategies to resonate with each segment, optimizing the impact of social signals on SEO.

Content Performance Analysis

Analyzing the performance of different types of content can uncover what resonates most with your audience. By segmenting content analytics, startups can identify which topics, formats, and delivery channels yield the best SEO results from social signals. This insight is invaluable for refining content strategies to focus on high-performing areas, ensuring resources are allocated efficiently.

The Role of Qualitative Insights

Social Listening for Sentiment Analysis

While quantitative metrics provide the what, qualitative insights offer the why behind the impact of social signals on SEO. Employing social listening tools for sentiment analysis can give startups a deeper understanding of the audience’s perceptions, concerns, and expectations. In the financial services sector, where trust and credibility are paramount, these insights can guide how to structure content and engagement strategies to positively influence SEO outcomes.

Customer Feedback Loops

Direct feedback from customers, whether through social media interactions, surveys, or comment sections, can provide actionable insights into how social signals affect SEO performance. Encouraging and facilitating customer feedback not only strengthens the relationship with your audience but also provides direct input into content effectiveness and areas for improvement.

Synthesizing Insights into Actionable Strategies

Data-Driven Decision Making

The ultimate goal of measuring the impact of social signals on SEO is to inform strategic decisions. This requires a synthesis of quantitative metrics, qualitative insights, and predictive analytics into a coherent strategy that aligns with business objectives. For financial services startups, this means adopting a data-driven approach to content creation, audience engagement, and platform optimization.

Continuous Learning and Adaptation

The digital landscape is ever-evolving, and so too should be the strategies employed by startups. Regularly reviewing and analyzing the impact of social signals on SEO allows for continuous learning and adaptation. It’s about creating a feedback loop where insights from analytics inform strategic adjustments, which are then measured and refined in a continual cycle of improvement.

A Strategic Framework for Impact Measurement

For startups in the financial services sector, measuring the impact of social signals on SEO is essential for navigating the competitive digital landscape. By employing advanced analytics, segmenting data for deeper insights, understanding qualitative dynamics, and synthesizing these insights into actionable strategies, startups can not only measure but also maximize the impact of their social and SEO efforts.

This strategic framework empowers startups to not just compete but to lead in the digital age, leveraging the power of social signals to enhance their SEO performance and drive sustainable growth.

Tailoring Strategies for Optimal Synergy

With empirical and theoretical insights unveiling the potent impact of social signals on SEO, the focus for financial services pivots towards tailoring strategies that optimize this synergy.

User-First Approach

- Value Addition: Every piece of content, whether a blog post, video, or infographic, should be tailored to add value. In the financial landscape, this value addition isn’t optional but mandatory.

- Engagement: Content should invite engagement. It should resonate with users’ needs, queries, and aspirations, making engagement spontaneous and organic.

Analytics and Insights

- Data-Driven: Strategies should be data-driven. Analytics, both SEO and social media, should be the compass guiding content creation, social media posting, and engagement strategies.

- Insights Integration: Insights derived should be dynamically integrated. If social signals unveil certain content types or topics resonating with users, this insight should steer content creation.

Developing a Unified Content Strategy

Creating a Cohesive Brand Narrative

At the core of synergizing social signals and SEO is the development of a unified content strategy that articulates a cohesive brand narrative. This narrative should seamlessly weave through every piece of content, whether designed for social media or SEO purposes, ensuring a consistent brand message. For financial services startups, this means every blog post, social media update, video, or infographic not only delivers value but also reinforces the startup’s unique value proposition and brand voice.

Leveraging Diverse Content Formats

Embracing a variety of content formats can significantly enhance the engagement and reach of your content, thereby amplifying social signals and SEO benefits. Startups should consider diversifying their content portfolio to include webinars, podcasts, in-depth guides, and interactive tools tailored to financial services. This approach not only caters to different audience preferences but also leverages the unique strengths of each content type to improve search visibility and social engagement.

Enhancing Visibility through Strategic Keyword Integration

Conducting Comprehensive Keyword Research

A cornerstone of tailoring strategies for optimal synergy is conducting comprehensive keyword research that aligns with user search intent, especially within the financial services context. This involves identifying not just high-volume keywords but also long-tail phrases that reflect the specific queries of your target audience. For startups, leveraging these insights to craft content that addresses these queries can significantly improve SEO performance and social media engagement.

Integrating Keywords into Social Content

The strategic integration of keywords into social media content is often overlooked but can enhance visibility across channels. Startups should ensure that their social posts, especially those linking back to their website, include relevant keywords in a natural and engaging manner. This practice not only helps in aligning social content with SEO goals but also in making social posts more discoverable both on social platforms and search engines.

Fostering Community Engagement

Building and Nurturing Online Communities

The creation of online communities, where members can share experiences, ask questions, and engage in discussions related to financial services, can significantly amplify social signals and enhance SEO. Startups should focus on actively participating in these communities, providing valuable insights, answering queries, and sharing relevant content. This proactive engagement not only fosters trust and loyalty but also encourages community members to share content widely, boosting social signals.

Encouraging User-Generated Content

Encouraging user-generated content (UGC), such as reviews, testimonials, and social media mentions, can be a powerful strategy for enhancing both social signals and SEO. UGC not only provides authentic content that search engines value but also increases engagement on social media. Financial services startups can incentivize the creation of UGC through contests, featured stories, and social media shoutouts, thereby driving both social engagement and SEO benefits.

Leveraging Analytics for Continuous Optimization

Utilizing Analytics for Insight-Driven Adjustments

The dynamic nature of digital marketing necessitates a continuous optimization process, guided by data-driven insights. Startups should leverage analytics tools to monitor the performance of their content across social media and search engines, identifying what works and what doesn’t. This ongoing analysis allows for real-time adjustments to strategies, ensuring they remain aligned with evolving market trends and audience behaviors.

Setting Clear KPIs for Measuring Success

Defining clear key performance indicators (KPIs) is essential for measuring the success of integrated social and SEO strategies. For financial services startups, these KPIs could include metrics such as website traffic from social media, search engine rankings for targeted keywords, engagement rates on social posts, and conversion rates. Regularly tracking these KPIs provides actionable insights that can inform strategic decisions and optimizations.

Navigating the Path to Digital Excellence

For financial services startups, the path to digital excellence lies in the strategic fusion of social signals and SEO. By developing a unified content strategy, enhancing visibility through strategic keyword integration, fostering community engagement, and leveraging analytics for continuous optimization, startups can ensure their digital marketing efforts are not just aligned but synergized.

This tailored approach not only maximizes the impact of each marketing effort but also sets the stage for sustained growth and success in the competitive digital landscape.

Opinion of Industry Expert

Trust is Currency: More than any other sector, trust is paramount in finance. We ensure our content is backed by credible sources, and we’re always up-to-date with certifications and security badges. Local SEO Matters: For brick-and-mortar banks and financial institutions, local SEO is crucial. We optimize for local keywords and ensure our NAP (Name, Address, Phone Number) is consistent across all platforms. Complex Jargon Simplified: Financial terms can be daunting. We focus on creating content that breaks down complex topics, ensuring it’s accessible to all. It’s packed with entities, maintains high information density, and is internally linked with relevant pages.

Interactive Tools: Calculators, ROI estimators, and other interactive tools not only provide value but also boost on-page time, a positive signal for SEO. They can also generate a significant amount of natural backlinks. Q&A Sections: Given the myriad of questions people have about finance, we’ve found that having a robust Q&A section can capture a lot of long-tail keywords.

Voice Search Optimization: With more people using voice assistants, we’ve started optimizing for voice search, focusing on natural language queries. The early results? Pretty promising! Financial services SEO isn’t just about ranking high; it’s about building trust, providing value, and ensuring clarity.

Kyle Roof, Founder & CEO of Kyle Roof

Conclusion

In the multifaceted domain of financial services SEO, the silent symphony of social signals plays an instrumental role. It’s a narrative where likes, shares, and comments transcend their simplistic existence to become indicators of content value, user engagement, and brand authority.

As financial institutions and fintech companies navigate this intricate dance, may every social signal be a step towards enhanced SEO potency, may every like and share echo in the algorithms of search engines, and may the confluence of social engagement and search engine optimization herald a narrative of digital visibility, user engagement, and strategic empowerment in the competitive landscape of financial services.

Read Next:

- How to Use Pinterest for Healthcare SEO

- The Role of Social Signals in Healthcare SEO

- The Technical Aspects of International SEO for Healthcare

- Cultural Sensitivities in International Healthcare SEO

- Multilingual SEO for Global Healthcare Brands

Comments are closed.