(This Article has been revised, edited and added to, by Poulomi Chakraborty.)

- Why Personal Finance Blogs Matter

- Stats and Figures: The Reach of Personal Finance Blogs

- Real-life Impacts: Stories of Those Helped by Personal Finance Blogs

- The Role of Accessibility in Financial Education

- Bridging the Gap Between Expertise and Everyday Financial Decisions

- Creating a Culture of Financial Empowerment

- The Power of Personalization in Financial Narratives

- Strategic Engagement Through Diverse Content Formats

- Understanding the Target Audience

- Core Principles of Effective Money Management

- Engaging Your Audience

- Building Trust with Transparency and Authenticity

- Overcoming Common Challenges in Personal Finance Blogging

- Staying Updated with Ever-changing Financial Trends and Regulations

- Handling Negativity and Skepticism

- Ensuring Privacy and Security for Readers

- Navigating the Saturation of the Market

- Adapting to Changing Consumer Behaviors

- Balancing SEO and Authenticity

- Maintaining Consistency Amid Growth

- Handling Financial Information Responsibly

- Continuous Learning and Growth as a Personal Finance Blogger

- Wrapping it Up

In a world where financial complexities continue to grow and global economies often seem unstable, the need for personal financial education is more pressing than ever. Yet, traditional methods of imparting this knowledge—through textbooks, lectures, or intimidating financial seminars—often fall short. Enter the age of the personal finance blog: a fresh, relatable, and digestible way to convey financial wisdom and advice. Personal finance blogs have emerged as pivotal educational tools that harness real-life stories and experiences to guide readers through the labyrinth of money management.

Why Personal Finance Blogs Matter

The influence of personal finance blogs might be easy to underestimate. After all, in an era flooded with information, what makes these platforms stand out?

Stats and Figures: The Reach of Personal Finance Blogs

Studies suggest that over 60% of adults turn to the internet when seeking answers to their financial queries. Among these online resources, personal finance blogs claim a substantial chunk of traffic.

Real-life Impacts: Stories of Those Helped by Personal Finance Blogs

Take, for instance, Lisa, a 30-year-old freelance writer who found herself drowning in credit card debt. Through a blogger’s journey of eliminating debt, Lisa found actionable steps she could take.

The Role of Accessibility in Financial Education

In an increasingly digital world, the accessibility offered by personal finance blogs cannot be overstated. Traditional financial advice, often gatekept by high consulting fees or geographically bound seminars, excludes a vast portion of the population who may benefit the most from financial literacy. Personal finance blogs dismantle these barriers, offering free, high-quality advice to anyone with internet access.

For startup founders, this democratization of financial education is a call to action: to make their services and products as accessible as the knowledge shared on these platforms. Incorporating accessibility into your business model not only broadens your customer base but also aligns your startup with the values of inclusivity and empowerment.

Bridging the Gap Between Expertise and Everyday Financial Decisions

The gap between financial experts and the everyday individual is often widened by jargon and complex concepts that feel out of reach. Personal finance blogs play a crucial role in bridging this gap, translating expert advice into actionable, understandable steps. For startup founders, this underscores the importance of clear communication.

Whether you’re developing a financial service or a product outside the financial sphere, the ability to convey your value proposition in relatable terms can be the difference between success and obscurity. Engage your audience by simplifying complex ideas without diluting their value, much like successful personal finance blogs.

Creating a Culture of Financial Empowerment

Personal finance blogs do more than educate; they empower. They transform passive readers into active participants in their financial journey. This empowerment ethos can be a powerful lesson for startups. Creating a product or service that empowers your users, giving them tools to make informed decisions, can foster a loyal and engaged community.

Consider how your startup can contribute to a culture of empowerment. This could be through educational content, user-friendly services, or community-building efforts that give your audience a sense of ownership and control over their decisions.

The Power of Personalization in Financial Narratives

Personal finance blogs excel in personalization, often sharing stories and advice tailored to specific life stages, goals, or challenges. This personal touch not only makes the content more relatable but also increases its impact.

Startups, especially in the digital marketing domain, can take a cue from this approach by leveraging data and analytics to personalize their offerings. Understanding your audience’s preferences, challenges, and goals allows you to tailor your marketing strategies and product offerings, making your startup’s solutions more relevant and attractive.

Strategic Engagement Through Diverse Content Formats

The success of personal finance blogs lies not only in the content but also in the variety of formats used to engage readers. From long-form articles to interactive tools, these blogs cater to diverse preferences, enhancing engagement and retention. For startups, employing a multi-format content strategy can significantly increase your reach and impact.

Explore different content types—blogs, videos, podcasts, webinars—to communicate your message and engage with your audience in the way they prefer. This strategic engagement helps in building a comprehensive brand presence that resonates with a broader audience.

Understanding the Target Audience

For a personal finance blog to make waves, it’s imperative to know the audience intimately.

Profile of a Typical Personal Finance Blog Reader

- Demographics: Millennials and Gen Zers form a significant segment of readers.

- Financial Goals: Their goals revolve around achieving financial independence.

- Common Challenges Faced: Challenges include student loans, the gig economy’s unpredictability, and the allure of impulsive online shopping.

Why Understanding Your Audience is Crucial for Effective Education

Crafting content that resonates, inspires, and helps becomes possible by truly grasping readers’ needs.

The Evolution of Audience Expectations

In an era where consumer expectations are continuously evolving, understanding your target audience has never been more critical. For personal finance blogs, and by extension, startups, recognizing these shifts can provide a competitive edge. The modern reader is not just looking for information; they seek a personalized, engaging experience that resonates with their individual financial journey.

Startups must, therefore, not only identify who their audience is but also understand their behaviors, preferences, and pain points. This deep dive into audience analysis is the foundation for creating products or services that truly meet the evolving needs of your market.

Leveraging Data for Deeper Insights

In the quest to understand your audience better, data is your most valuable ally. Utilizing analytics tools to monitor user engagement on your blog or website can reveal invaluable insights about your audience’s interests, behavior patterns, and engagement preferences.

For startups, this means going beyond surface-level demographics to analyze the content that drives the most engagement, the questions that frequently arise, and the feedback provided by your community. This data-driven approach allows you to tailor your offerings and content strategy to more effectively meet your audience’s needs, enhancing user satisfaction and loyalty.

Segmenting Your Audience for Tailored Communication

One size does not fit all, especially when it comes to engaging with your audience. Segmenting your audience based on specific criteria such as age, financial goals, or challenges faced allows for more targeted and relevant communication. For personal finance blogs, this could mean creating content streams that cater to different segments, such as millennials looking to pay off student loans or middle-aged readers planning for retirement.

For startups, applying this segmentation strategy can improve marketing efforts, ensuring that the right message reaches the right audience at the right time. Tailored communication not only increases engagement but also builds a deeper connection with your audience.

Engaging with Your Audience on Multiple Platforms

Understanding your target audience also means knowing where they spend their time. In today’s fragmented digital landscape, your audience might be spread across various platforms, from traditional blogs and email newsletters to social media channels and podcasts.

For startups, establishing a presence across these platforms ensures that you are where your audience is, allowing for multiple touchpoints and engagement opportunities. By diversifying your content distribution, you not only increase your reach but also reinforce your brand’s presence in your audience’s daily life.

The Power of Community Building

At the heart of understanding your target audience is the recognition of their desire to belong to a community. People gravitate towards personal finance blogs not just for the information but for the sense of community they offer. For startups, fostering a community around your brand can be a powerful tool for engagement and retention.

Creating spaces for your audience to share experiences, ask questions, and support each other builds a loyal following. Whether through forums, social media groups, or interactive webinars, investing in community building initiatives can turn casual readers into brand advocates.

Adapting to Audience Feedback in Real-Time

The final piece in truly understanding your audience is the ability to listen and adapt to their feedback in real time. The digital landscape offers an unprecedented opportunity to engage in two-way conversations with your audience. Monitoring comments on blog posts, social media interactions, and feedback from email surveys can provide real-time insights into your audience’s needs and perceptions.

For startups, being agile enough to respond to this feedback—whether it means tweaking a product feature, adjusting your content strategy, or simply engaging in conversation—demonstrates a commitment to meeting your audience’s needs. This responsiveness not only improves your offerings but also strengthens trust and loyalty among your audience.

Core Principles of Effective Money Management

Budgeting

- The Foundations of a Good Budget: Budgeting offers clarity and is a reflection of one’s priorities.

- Tools and Apps for Better Budgeting: Tools like Mint, YNAB, and PocketGuard have revolutionized budgeting.

Saving and Investing

- Importance of an Emergency Fund: An emergency fund acts as a financial buffer against life’s unpredictabilities.

- Basics of Investing: With platforms like Robinhood, even novices can venture into the world of investing.

Cultivating Financial Discipline in Startups

At the core of effective money management is the principle of financial discipline, an invaluable trait for both individuals and startups alike. For startups, this discipline translates into rigorous budgetary control and a steadfast commitment to financial health.

Founders must prioritize establishing a culture of financial accountability from the outset, ensuring that every dollar spent contributes directly to the startup’s strategic objectives. This involves regular financial reviews, setting clear budgetary guidelines, and adhering to them without compromise. In doing so, startups can avoid the common pitfalls of overspending or misallocating funds, thereby safeguarding their financial stability and ensuring sustainable growth.

Strategic Investment for Long-term Growth

While budgeting and saving are foundational elements of effective money management, strategic investment is the engine that drives long-term growth. For startups, making informed investment decisions is crucial for scaling operations and expanding market reach. This entails not just financial investments in assets or securities but also investments in technology, human resources, and product development.

Startups must develop a keen eye for opportunities that offer not just immediate returns but also contribute to the strategic vision of the company. By balancing short-term gains with long-term objectives, startups can navigate the complex financial landscape more effectively, ensuring that they remain competitive and resilient in the face of challenges.

Harnessing Financial Analytics for Insightful Decision Making

In today’s data-driven world, the ability to interpret financial analytics offers a significant competitive advantage. For startups, leveraging financial data can uncover insights that drive smarter, more informed decision-making. This involves analyzing cash flow patterns, customer acquisition costs, and return on investment for various initiatives. By developing competencies in financial analytics, startups can anticipate trends, optimize operations, and allocate resources more efficiently.

Furthermore, this analytical approach allows founders to identify potential financial risks before they become critical, enabling proactive measures to mitigate them. Embracing financial analytics is not just about crunching numbers; it’s about crafting a strategic narrative that guides the startup’s journey toward financial sustainability and success.

Building Financial Resilience Through Diversification

Diversification is a well-established principle in personal finance that is equally pertinent to startups. In the context of a startup, diversification can mean exploring multiple revenue streams, expanding into new markets, or developing a range of products. This strategy mitigates risk by ensuring that the startup’s financial health is not dependent on a single source of income.

By building a diversified portfolio of revenue-generating activities, startups can absorb financial shocks more effectively, ensuring stability and continuity in operations. Moreover, diversification opens up new opportunities for growth and innovation, allowing startups to remain agile and adaptable in an ever-changing business environment.

Emphasizing Ethical Financial Practices

Integrity and transparency in financial management are not just ethical imperatives but strategic ones as well. Startups that uphold high standards of financial ethics are more likely to build trust with investors, customers, and partners. This involves clear reporting, transparent operations, and a commitment to fair practices in all financial dealings.

By embedding ethical considerations into financial decisions, startups can avoid the reputational damage associated with financial misconduct, which can be particularly devastating for new ventures. Furthermore, a reputation for integrity can be a powerful differentiator in the marketplace, attracting customers, talent, and investors who value corporate responsibility. In the journey toward financial mastery, ethical financial practices serve as both a moral compass and a strategic asset.

Engaging Your Audience

Building an insightful blog is only half the battle. The real challenge lies in capturing and retaining your reader’s attention, fostering a space where learning about finance feels less like a chore and more like an intriguing conversation.

Utilizing Compelling Storytelling

Personal Anecdotes and Success Stories

The power of storytelling cannot be overstated. Sharing personal journeys—mistakes, triumphs, and all—makes for content that is both relatable and aspirational. It reminds readers that financial success and setbacks are a shared human experience.

Real-life Examples to Illustrate Concepts

Abstract financial concepts can be made digestible by tying them to everyday scenarios. For instance, explaining the idea of compound interest using a relatable analogy makes the principle easier to grasp.

Interactive Content

Quizzes and Calculators

Engagement spikes when readers can interact with content. Budget calculators or financial literacy quizzes are not only informative but also add an element of fun and participation. A well-designed infographic can simplify a complex financial topic, making it both visually appealing and easier to understand.

Utilizing Multimedia

- Videos: A short explainer video on a financial topic can be both engaging and informative. Platforms like YouTube also offer an additional avenue to reach audiences.

- Podcasts: With the rising popularity of podcasts, discussing money matters in this format can be a more personal and relaxed way of educating.

- Webinars: Interactive sessions where readers can ask questions in real-time can add significant value and foster community.

Crafting a Compelling Narrative

The art of storytelling transcends mere entertainment; it is a powerful tool to connect, engage, and inspire your audience. For startups and personal finance blogs alike, weaving a compelling narrative around your brand or the financial insights you share can transform the way your audience perceives and interacts with your content. This narrative should not only articulate the value you offer but also resonate with the aspirations, challenges, and experiences of your audience.

By telling a story that reflects the journey of your startup or the financial successes and setbacks of real people, you create an emotional connection that can significantly enhance engagement and loyalty. Strategic storytelling involves a careful blend of authenticity, relevance, and inspiration, ensuring that your message not only captures attention but also motivates action.

Leveraging User-Generated Content

In the quest to engage your audience, one often underutilized strategy is the incorporation of user-generated content. Encouraging your readers or customers to share their own stories, tips, or testimonials not only fosters a sense of community but also adds a layer of authenticity and relatability to your platform. For startups, showcasing real-life applications of your product or service can be incredibly persuasive.

This approach not only validates your offering through the experiences of your users but also provides fresh, diverse content that keeps your audience coming back for more. User-generated content can take various forms, from guest blog posts and social media shoutouts to video testimonials and case studies, each offering a unique perspective that enriches your content strategy.

Interactive and Immersive Experiences

The digital age offers unprecedented opportunities to engage audiences through interactive and immersive experiences. Beyond traditional blog posts and articles, consider how interactive elements like quizzes, calculators, or even augmented reality (AR) experiences can bring your financial advice or startup’s value proposition to life.

These tools not only enhance learning by making complex concepts more accessible but also increase user engagement through active participation. For startups, interactive product demos or financial planning tools can provide a hands-on understanding of what you offer, helping to demystify your services and deepen user engagement. Incorporating these elements into your content strategy can set you apart, offering your audience not just information but an experience.

Personalization at Scale

In today’s crowded digital landscape, personalization is key to cutting through the noise and engaging your audience effectively. Utilizing data analytics and AI, startups can tailor their communication and content to the individual preferences and behaviors of their users. This level of personalization ensures that each interaction feels relevant and meaningful, significantly enhancing user engagement.

Whether it’s through personalized email campaigns, content recommendations, or customized financial advice, showing your audience that you understand their unique needs and preferences can foster a deeper connection and loyalty. For personal finance blogs and startups alike, investing in technologies and strategies that enable personalization at scale can be a game-changer, transforming passive readers and potential customers into active, engaged community members.

Continuous Engagement Through Feedback Loops

Creating a feedback loop with your audience is essential for sustained engagement. Encouraging and acting on feedback shows that you value your audience’s input and are committed to continuous improvement. This can be facilitated through surveys, comment sections, social media interactions, or direct communication channels. For startups, this feedback is invaluable not only for refining your products and services but also for identifying content that resonates with your audience.

By continuously adapting your content strategy based on user feedback, you can ensure that your blog remains a dynamic, responsive resource that truly meets the needs of your audience. Establishing regular touchpoints for feedback and demonstrating that you’re listening and evolving based on that feedback can significantly enhance audience loyalty and engagement.

Related: Check out our free SEO suite

Building Trust with Transparency and Authenticity

Trust is the cornerstone of any successful personal finance blog. Readers are, after all, entrusting bloggers with their most pressing financial concerns.

- Sharing Personal Finance Journeys: It’s not about showcasing only successes but being transparent about failures too. Financial missteps and how they were overcome can be immensely educational.

- Addressing Potential Conflicts of Interest: If recommending a product or service, transparency about affiliations or sponsorships is crucial. It establishes credibility.

- Reviews and Recommendations: The Importance of Integrity: Whether reviewing a financial tool or a book, unbiased and honest opinions strengthen trust. Readers value sincerity over glowing, but insincere, endorsements.

Cultivating a Culture of Openness

In the realm of personal finance and startup ventures, establishing a culture of openness is paramount for building trust. This involves more than just transparency about products or services; it means creating a dialogue with your audience that is genuine and open-ended. For startups, this could mean sharing behind-the-scenes insights into your operations, challenges, and successes through regular updates or blog posts.

By pulling back the curtain on your processes and decisions, you invite your audience to understand and participate in your journey. This level of openness not only humanizes your brand but also fosters a sense of shared experience and mutual respect, laying a strong foundation for trust.

Implementing Ethical Marketing Practices

In an age where consumers are increasingly wary of marketing tactics, adhering to ethical marketing practices is crucial for building and maintaining trust. This means avoiding exaggerated claims, transparently disclosing partnerships or sponsorships, and ensuring that your marketing messages are honest and accurate.

For personal finance blogs and startups, it’s important to remember that your audience is seeking reliable information and solutions that can impact their financial well-being. By prioritizing integrity in your marketing efforts, you demonstrate a commitment to your audience’s best interests, reinforcing trust and credibility.

Prioritizing User Privacy and Data Security

With digital privacy concerns at an all-time high, demonstrating a commitment to user privacy and data security is non-negotiable for building trust. This goes beyond compliance with regulations like GDPR or CCPA; it’s about treating your audience’s personal information with the utmost care and respect.

Startups should invest in robust security measures, be transparent about how user data is collected, used, and protected, and provide users with control over their own data. By making privacy and security a cornerstone of your operations, you reassure your audience that their information is in safe hands, which is particularly crucial when dealing with personal finance information.

Offering Value Before Expecting Returns

A powerful strategy for building trust is to offer value without immediately expecting something in return. This could be in the form of free resources, tools, or advice that genuinely helps your audience navigate their financial journey. For startups, this approach can help establish your brand as a helpful and reliable authority in your field.

Providing value upfront demonstrates that you’re invested in your audience’s success, not just your own. This long-term approach to relationship building can lead to higher levels of engagement, loyalty, and trust, as your audience comes to see you as a trusted advisor rather than just another business.

Encouraging Community Engagement and Support

Building trust isn’t just about the relationship between your brand and your audience; it’s also about fostering a supportive community around your brand. Encourage your audience to share their experiences, challenges, and successes with each other, whether through comments, forums, or social media groups.

For startups, facilitating these interactions can amplify the sense of trust and camaraderie within your community. When audience members see others benefiting from your advice or products, their trust in your brand grows. Plus, a vibrant, supportive community can become a powerful advocate for your brand, extending trust through word-of-mouth and peer recommendations.

Overcoming Common Challenges in Personal Finance Blogging

Like any endeavor, personal finance blogging has its own set of challenges. Navigating these obstacles with grace can distinguish a good blog from a great one.

Staying Updated with Ever-changing Financial Trends and Regulations

Financial landscapes evolve constantly. Whether it’s changing tax regulations, new investment opportunities, or shifting global economies, a successful blogger stays informed. Regularly consuming content from financial news giants like Bloomberg, CNBC, or Financial Times can help. Forums, social media groups, and financial communities like r/PersonalFinance on Reddit can be goldmines of the latest trends and discussions.

Handling Negativity and Skepticism

The online world can be critical. Not every reader will agree, and not all feedback will be positive. Encouraging constructive criticism and open discussions can transform negative feedback into growth opportunities. It’s essential to address skepticism or criticism with facts, respect, and patience.

Ensuring Privacy and Security for Readers

If a blog offers financial tools, quizzes, or any feature that collects user data, safeguarding that information is paramount. SSL certificates, regular site audits, and secure hosting platforms are fundamental. A clear and concise privacy policy that informs readers about how their data is used builds trust.

Navigating the Saturation of the Market

The personal finance blogging space is highly saturated, with countless voices competing for attention. This presents a significant challenge for both emerging and established blogs seeking to carve out a unique niche. For startup founders, the lesson here is the importance of differentiation. Identifying a unique angle or focusing on a specific subset of personal finance that is underrepresented can help set your blog apart from the competition.

This could involve specializing in niche financial strategies, underserved demographics, or unique financial philosophies. Emphasizing your unique value proposition and consistently delivering content that aligns with it will help attract and retain a dedicated audience.

Adapting to Changing Consumer Behaviors

Consumer behaviors and preferences evolve rapidly, influenced by technological advancements, economic shifts, and cultural trends. Personal finance blogs must stay attuned to these changes to remain relevant and engaging. For startups, this underscores the necessity of agility and responsiveness.

Staying informed about emerging trends, leveraging analytics to understand audience behavior, and being willing to pivot your content strategy accordingly are crucial. Engaging directly with your audience to solicit feedback and insights can also guide your adaptations, ensuring that your content remains closely aligned with their evolving needs and interests.

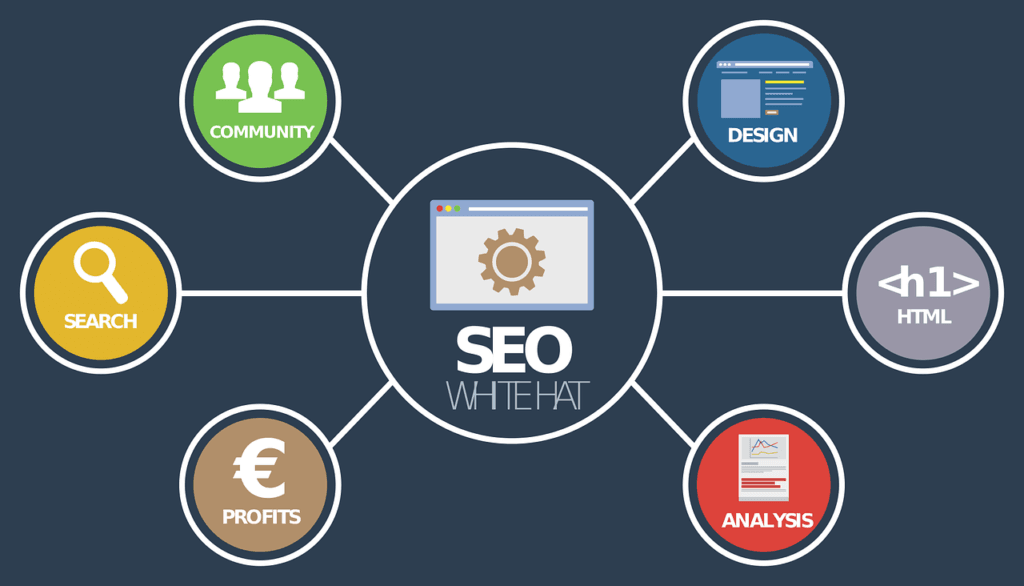

Balancing SEO and Authenticity

In the quest for visibility, personal finance bloggers often grapple with balancing search engine optimization (SEO) strategies with the need to maintain authenticity and voice. While SEO can significantly increase traffic and reach, overly optimized content may come across as insincere or generic. For startups, finding this balance is key to building an authentic brand that resonates with audiences while also achieving visibility in search engine results.

Integrating SEO best practices naturally within valuable, authentic content is the goal. This means focusing on quality, relevance, and user experience as much as keywords and backlinks. By prioritizing the needs and interests of your audience first, you can craft content that performs well both in search engines and in fulfilling your audience’s expectations.

Maintaining Consistency Amid Growth

As personal finance blogs grow, maintaining the consistency of content quality, voice, and publishing frequency can become challenging. This is a critical issue as consistency is a key factor in building and retaining audience trust and engagement. For startups, the lesson is clear: systems, processes, and planning are essential for scaling effectively.

Investing in content planning tools, establishing editorial guidelines, and possibly expanding your team to include writers, editors, or content managers can help manage growth without sacrificing consistency. Additionally, leveraging technology to automate certain aspects of content creation and distribution can free up time to focus on maintaining quality and engagement.

Handling Financial Information Responsibly

Given the sensitive nature of financial advice, personal finance bloggers must navigate the responsibility of providing accurate, reliable information. Misinformation can lead to financial losses for readers and damage to the blogger’s credibility. For startups, this highlights the importance of due diligence and fact-checking.

Ensuring that your content is reviewed by financial experts, staying informed about the latest developments in the field, and clearly communicating the potential risks and limitations of your advice are all critical practices. This responsible approach not only safeguards your audience but also reinforces your reputation as a trustworthy source of financial information.

Continuous Learning and Growth as a Personal Finance Blogger

To lead, one must first learn. Continuous growth and education are indispensable for a blogger aiming to educate others.

- Recommended Courses and Certifications: Whether it’s a course on advanced investment strategies, behavioral finance, or even content creation, continual learning enriches blog content.

- Attending Industry Conferences: Conferences not only offer learning but also networking opportunities. Meeting industry peers can lead to collaborations, partnerships, or simply fresh perspectives.

- Networking with Other Personal Finance Experts: Regular interactions with other experts can provide new insights, keep one updated, and even offer collaborative opportunities.

The journey of a personal finance blogger is not just about numbers; it’s about impact. By weaving financial principles with relatable narratives, employing engaging tools, and prioritizing readers’ trust, these blogs become more than just online platforms. They transform into lifelines, guiding lights, and even catalysts for change in their readers’ financial journeys.

Embracing the Role of a Lifelong Learner

In the fast-paced world of finance and entrepreneurship, the only constant is change. This reality necessitates a commitment to lifelong learning, not just as a necessity but as a strategic advantage. For personal finance bloggers and startup founders alike, staying abreast of new financial theories, market trends, and technological advancements is critical.

This ongoing education can come from a variety of sources, including academic courses, industry newsletters, podcasts, and conferences. By positioning yourself as a student of the industry, you ensure that your content and business strategies remain relevant, insightful, and valuable to your audience.

Leveraging Mentorship and Professional Networks

The journey of continuous learning is often enriched by the insights and experiences of peers and mentors. Engaging with a community of like-minded professionals can provide personal finance bloggers and startup founders with unique perspectives, advice, and support. This network can be built through social media platforms, industry associations, and professional networking events.

Establishing mentorship relationships, whether as a mentor or mentee, can also play a pivotal role in personal and professional development. These relationships offer direct access to experienced insights, fostering a deeper understanding of complex financial concepts and business strategies.

Diversifying Knowledge Through Cross-disciplinary Learning

The field of personal finance does not exist in isolation; it intersects with numerous other disciplines, including psychology, technology, and law. For bloggers and startups, exploring these cross-disciplinary connections can unlock innovative approaches to content creation and business development.

For instance, understanding psychological principles can enhance how you engage with your audience, while staying informed about technological advancements can lead to more efficient content distribution strategies. Diversifying your knowledge base in this way not only enhances the depth and breadth of your expertise but also fosters creative thinking and innovation.

Investing in Advanced Analytics for Content Optimization

In the digital age, data analytics offers powerful insights into audience behavior, content performance, and engagement metrics. For personal finance bloggers and startups, investing in advanced analytics tools can guide strategic decisions about content creation, marketing, and product development.

These tools can identify trends in what topics resonate most with your audience, the most effective content formats, and optimal publishing times. By harnessing the power of data, you can tailor your content strategy to better meet the needs of your audience, driving growth and engagement.

Prioritizing Feedback Loops for Continuous Improvement

Feedback from your audience is one of the most valuable resources for continuous learning and growth. Encouraging readers to share their thoughts, experiences, and suggestions not only fosters a sense of community but also provides direct insights into how you can improve your content and services. Implementing mechanisms for collecting and analyzing feedback, such as surveys, comment sections, and social media interactions, is crucial.

This feedback loop allows you to make iterative improvements to your blog or startup, ensuring that your offerings remain aligned with your audience’s evolving needs and preferences. By embracing feedback as a tool for continuous learning, you demonstrate a commitment to excellence and adaptability.

Wrapping it Up

As we journey through the evolving landscape of personal finance, the role of blogs in educating and empowering individuals stands out as both vital and transformative. Personal finance blogs not only demystify the complexities of financial management but also serve as beacons, guiding readers towards informed decisions and financial independence. For startup founders, the insights derived from these platforms underscore the importance of clarity, engagement, and trust in building successful ventures.

By incorporating strategies for continuous learning, audience engagement, and transparent communication, startups can navigate the financial intricacies of their journey with confidence. As we conclude this exploration, remember that the path to mastering money management and entrepreneurial success is an ongoing process of education, adaptation, and community building. Let’s continue to share knowledge, challenge our assumptions, and support each other in our collective quest for financial wisdom and growth.

Read Next:

- How to Create A Blog Post That Goes Viral And Brings Links

- How to Create a Great Infographic that People Want to Share: Tips from Experts

- 21+ Ways Chatbots can Skyrocket Lead Generation and Conversions

- How to use Autopilot: An Explainer

- How to Use Behavioral Email Segmentation: The Definitive Guide

Comments are closed.