This Article has been revised, edited and added to, by Poulomi Chakraborty.

- Understanding Geofencing

- Implementing Geofencing in Local Banks

- Advanced Strategies for Leveraging Geofencing for SEO

- Future Trends in Geofencing and Local SEO

- Implementing Future Trends in Geofencing and Local SEO

- Augmented Reality (AR) and Virtual Reality (VR) in Banking

- Voice Search Optimization for Local Banks

- Artificial Intelligence (AI) and Machine Learning in Geofencing

- Internet of Things (IoT) and Smart Banking

- Blockchain Technology in Banking

- Hyper-Personalization in Marketing

- 5G Technology and Enhanced Connectivity

- Ethical SEO and Data Privacy Practices

- Sustainable and Socially Responsible Practices

- Summary and Actionable Steps for Implementing Geofencing and SEO Strategies for Local Banks

- Summary

- Actionable Steps

- Step 1: Choose the Right Geofencing Platform

- Step 2: Define Geofence Boundaries

- Step 3: Develop Targeted Content

- Step 4: Integrate Geofencing with Mobile Banking Apps

- Step 5: Optimize for Voice Search

- Step 6: Leverage AI and Machine Learning

- Step 7: Implement IoT and Smart Technologies

- Step 8: Utilize Blockchain for Security

- Step 9: Create Hyper-Local Content

- Step 10: Engage with Local Influencers

- Step 11: Monitor and Analyze Performance

- Step 12: Prioritize Ethical SEO and Data Privacy

- Step 13: Promote Sustainability and Community Engagement

- Step 14: Embrace Future Technologies

- Conclusion

In today’s digital landscape, banks and financial institutions constantly seek new ways to connect with customers and stay ahead of the competition. One innovative technology that is gaining traction is geofencing. This technology allows businesses to create virtual boundaries around specific locations, enabling them to send targeted messages to potential customers when they enter these areas. For local banks, geofencing presents a unique opportunity to enhance their marketing strategies and improve their SEO performance. This article delves into what geofencing is, how it works, and its implications for local banks’ SEO strategies.

Geofencing isn’t just a buzzword; it’s a powerful tool that can transform how local banks engage with their customers. By leveraging this technology, banks can deliver personalized content, promotions, and services to individuals within a defined geographic area. This targeted approach can significantly enhance customer experience, drive foot traffic to physical branches, and boost online visibility through improved local SEO.

Understanding Geofencing

Geofencing involves using GPS, RFID, Wi-Fi, or cellular data to create a virtual boundary around a specific location. When a user enters or exits this boundary, the system triggers a pre-set action, such as sending a notification, email, or text message.

This capability makes geofencing a versatile tool for various applications, from marketing and advertising to security and asset management.

For local banks, the primary advantage of geofencing lies in its ability to deliver location-specific content to potential customers. Imagine a scenario where a customer walks past a bank branch and receives a notification about a special promotion on savings accounts. This immediate, relevant communication can capture the customer’s attention and prompt them to visit the branch.

Geofencing vs. Traditional SEO

To understand the true potential of geofencing for local banks, it’s essential to compare it with traditional SEO techniques. Traditional SEO focuses on optimizing a website to rank higher in search engine results for relevant keywords.

This involves on-page optimization, backlink building, and content creation aimed at increasing organic traffic. While effective, traditional SEO often requires significant time and resources to achieve desired results.

Geofencing, on the other hand, offers a more immediate and localized approach. By targeting users based on their physical location, banks can deliver timely and relevant messages that drive immediate action.

This real-time engagement can complement traditional SEO efforts by enhancing the overall customer experience and encouraging in-person visits to bank branches.

However, geofencing and traditional SEO are not mutually exclusive. Instead, they can work together to create a comprehensive marketing strategy. For instance, geofencing can drive foot traffic to branches, while a well-optimized website can provide detailed information and support online banking services. By integrating both approaches, local banks can maximize their reach and effectiveness.

SEO Implications of Geofencing

The integration of geofencing into a local bank’s marketing strategy has several implications for SEO. One of the most significant is the potential for increased local search visibility.

Search engines prioritize businesses that are relevant to the user’s current location, and geofencing helps banks establish this relevance. By targeting users in specific areas and encouraging them to engage with the bank, geofencing can improve local search rankings and drive more organic traffic.

Moreover, geofencing can enhance the user experience, which is a critical factor in SEO. When users receive relevant and timely messages, they are more likely to engage with the content and the business.

This increased engagement can lead to higher click-through rates, longer dwell times, and more positive reviews—all of which contribute to improved SEO performance.

Another key SEO implication of geofencing is the potential for generating high-quality local backlinks. When users visit a bank branch in response to a geofencing notification, they may share their experience on social media or local review sites.

These shares and reviews can create valuable backlinks that boost the bank’s local SEO efforts.

Implementing Geofencing in Local Banks

Setting Up Geofencing Technology

Implementing geofencing technology in a local bank involves several steps, starting with the selection of a geofencing platform. Various platforms offer geofencing services, each with unique features and capabilities. It’s essential to choose a platform that aligns with the bank’s objectives and integrates seamlessly with existing systems.

Once a platform is selected, the next step is defining the geofence boundaries. These boundaries can be as small as a few meters or as large as several kilometers, depending on the bank’s goals.

For instance, a bank might set up a geofence around its branches, ATM locations, or competitor banks to capture potential customers in those areas.

After defining the boundaries, banks need to create the content and actions that will be triggered when users enter or exit the geofence. This content could include promotional offers, reminders about banking services, or information about new products.

It’s crucial to ensure that the messages are relevant, timely, and add value to the recipient, as this increases the likelihood of engagement.

Integrating Geofencing with Mobile Banking Apps

Mobile banking apps are an ideal platform for integrating geofencing technology. Since customers often carry their smartphones, geofencing through a mobile app allows banks to reach customers in real-time.

By incorporating geofencing capabilities into the app, banks can send location-based notifications and alerts to users who have opted in to receive them.

To integrate geofencing with a mobile banking app, banks need to ensure that the app’s code supports geofencing functionality. This might involve working with app developers to update the app’s software and ensure it can communicate with the geofencing platform.

Once integrated, banks should test the functionality thoroughly to ensure notifications are delivered accurately and promptly.

Personalizing Customer Interactions

One of the significant advantages of geofencing is the ability to personalize customer interactions based on their location. By leveraging geofencing data, banks can tailor their messages to meet the specific needs and preferences of their customers.

For example, a customer entering a geofence near a bank branch could receive a notification about a loan offer available only at that branch.

Personalization extends beyond mere location-based offers. Banks can use geofencing data to understand customer behavior patterns and preferences, allowing them to create more targeted marketing campaigns.

For instance, if a customer frequently visits a particular branch, the bank can offer personalized services or products that cater to that customer’s financial needs.

Enhancing Customer Experience

Geofencing can significantly enhance the customer experience by providing timely and relevant information. Imagine a scenario where a customer is near a bank branch and receives a notification about extended branch hours or a special event happening at that location.

This type of real-time communication can enhance the customer’s experience and foster a stronger connection with the bank.

Additionally, geofencing can streamline customer interactions by providing useful information when it’s most needed. For example, a customer entering a geofence near an ATM might receive a notification with tips on avoiding ATM fees or information about the bank’s mobile banking features. This proactive approach can improve customer satisfaction and loyalty.

Measuring the Effectiveness of Geofencing Campaigns

To ensure the success of geofencing campaigns, banks must track and measure their effectiveness. Key performance indicators (KPIs) such as engagement rates, click-through rates, and conversion rates can provide valuable insights into how well the campaigns are performing.

By analyzing these metrics, banks can identify what works well and what needs improvement.

Additionally, banks should gather feedback from customers who receive geofencing notifications. Surveys and feedback forms can help banks understand how customers perceive these messages and whether they find them useful.

This feedback can inform future geofencing campaigns and ensure they are aligned with customer preferences and expectations.

Addressing Privacy Concerns

While geofencing offers numerous benefits, it also raises privacy concerns that banks must address. Customers need to feel confident that their location data is being used responsibly and securely. Banks should be transparent about how they collect, use, and protect customer data, and ensure compliance with relevant data privacy regulations.

Providing clear opt-in and opt-out options is crucial for maintaining customer trust. Customers should have control over whether they want to receive location-based notifications and should be able to easily change their preferences.

By prioritizing privacy and transparency, banks can build trust and encourage more customers to opt into geofencing notifications.

Advanced Strategies for Leveraging Geofencing for SEO

Creating Hyper-Local Content

Hyper-local content targets a very specific area or community, providing highly relevant information to users within that locale. For local banks, creating hyper-local content can significantly enhance geofencing efforts and improve local SEO.

This content can include blog posts about local financial trends, guides on how to use banking services within specific neighborhoods, and updates on community events supported by the bank.

For example, if a bank has a branch in a small town, it could create content such as “Managing Your Finances in [Town Name]: Tips from Your Local Bank.” This not only attracts local search traffic but also builds a connection with the community by addressing their unique needs and interests.

Leveraging User-Generated Content

User-generated content (UGC) is a powerful way to enhance local SEO and engage with the community. Encouraging customers to share their experiences with the bank on social media or review platforms can create valuable content that boosts local search visibility.

Banks can incentivize this by offering promotions or contests for customers who share their stories or leave reviews.

Geofencing can support this strategy by sending notifications to customers asking them to share their experience after visiting a branch. For instance, a message could say, “We hope you had a great visit! Share your experience on social media with #BankName for a chance to win a gift card.” This not only generates authentic content but also increases engagement and brand visibility.

Utilizing Location-Based Keywords

Location-based keywords are essential for improving local SEO. Banks should conduct thorough keyword research to identify the most relevant and high-performing keywords for their specific locations. These keywords should be naturally integrated into website content, blog posts, and social media updates.

For instance, instead of generic terms like “banking services,” a local bank might use keywords such as “best banking services in [City Name]” or “affordable loans in [Neighborhood Name].” These specific keywords help search engines understand the bank’s geographical relevance, improving the chances of appearing in local search results.

Collaborating with Local Influencers

Partnering with local influencers can amplify a bank’s geofencing and SEO efforts. Influencers with a strong local following can promote the bank’s services, share their experiences, and create buzz around geofencing campaigns. This not only drives local traffic but also generates high-quality backlinks and social media engagement, boosting SEO.

For example, a local influencer could be invited to a bank-sponsored community event, and their coverage of the event can include geofencing promotions and keywords. The influencer’s audience, who are likely from the same geographic area, will be more inclined to engage with the bank’s content and services.

Incorporating Interactive Content

Interactive content, such as quizzes, calculators, and polls, can significantly enhance user engagement and SEO. Local banks can create interactive tools that address the specific needs of their community. For instance, a mortgage calculator tailored to the local real estate market can attract users who are specifically interested in buying homes in that area.

Geofencing can be used to promote these interactive tools to users in the vicinity of the bank’s branches. For example, a notification might say, “Planning to buy a home in [City Name]? Try our mortgage calculator to see how much you can afford.”

This not only provides immediate value to the user but also increases the likelihood of them visiting the bank’s website and engaging with its content.

Enhancing Mobile User Experience

Since geofencing primarily targets mobile users, ensuring an excellent mobile user experience is crucial for local banks. A mobile-friendly website that loads quickly, is easy to navigate, and provides all necessary information can significantly improve user engagement and SEO.

Banks should regularly test their websites on various mobile devices to ensure compatibility and performance. Features such as click-to-call buttons, mobile-optimized forms, and simple navigation can enhance the user experience and encourage more interactions.

Additionally, content should be concise and easily readable on small screens to maintain user interest and reduce bounce rates.

Conducting A/B Testing

A/B testing, or split testing, involves comparing two versions of a webpage or notification to determine which performs better. This can be a valuable tool for optimizing geofencing campaigns and improving SEO.

By testing different messages, offers, and content formats, banks can identify what resonates most with their audience and refine their strategies accordingly.

For instance, a bank might test two different geofencing notifications: one offering a promotional rate on a new account and another highlighting a free financial planning session. By analyzing which notification generates more engagement and conversions, the bank can optimize future campaigns to maximize their impact.

Monitoring Competitor Strategies

Keeping an eye on competitors can provide valuable insights and help refine geofencing and SEO strategies. Banks should regularly analyze their competitors’ online presence, including their use of local keywords, geofencing campaigns, and content strategies. Tools like SEMrush and Ahrefs can help track competitor performance and identify opportunities for improvement.

Understanding what competitors are doing well can inspire new ideas and strategies. Conversely, identifying gaps in their approach can highlight opportunities for differentiation. For example, if a competitor is not leveraging geofencing effectively, a bank can capitalize on this by launching targeted geofencing campaigns to capture more local customers.

Future Trends in Geofencing and Local SEO

As technology continues to evolve, geofencing and local SEO strategies will also advance. Emerging trends such as augmented reality (AR) and virtual reality (VR) offer new possibilities for engaging customers and enhancing local SEO. For instance, banks could use AR to provide virtual tours of their branches or showcase new features in their mobile apps.

Voice search is another growing trend that banks need to consider. With the increasing use of voice-activated devices, optimizing content for voice search can improve local SEO. This involves using natural language keywords and creating content that answers common questions customers might ask using voice search.

Future Trends in Geofencing and Local SEO

Augmented Reality (AR) and Virtual Reality (VR)

Augmented reality and virtual reality are transforming the way businesses engage with customers, and banks are no exception. AR and VR offer immersive experiences that can enhance customer interactions and improve local SEO.

For instance, banks can use AR to provide virtual tours of their branches, showcasing features and services in a more engaging way. Customers can use their smartphones to see an overlay of information about the bank’s offerings as they walk past a branch.

Virtual reality can be used for remote consultations and virtual meetings, allowing customers to experience face-to-face interactions without physically visiting a branch. This can be particularly beneficial for financial planning sessions or mortgage consultations.

By integrating AR and VR into their marketing strategies, banks can create unique and memorable experiences that attract local customers and boost online visibility.

Voice Search Optimization

Voice search is rapidly gaining popularity, with more consumers using voice-activated devices like Amazon Alexa, Google Assistant, and Apple’s Siri to search for information.

For local banks, optimizing content for voice search is essential to stay relevant and visible in local search results. Voice search queries are typically longer and more conversational than text-based searches, so banks need to adapt their SEO strategies accordingly.

To optimize for voice search, banks should focus on natural language keywords and phrases that customers might use when speaking. For example, instead of targeting “bank in New York,” they might optimize for “where is the nearest bank in New York” or “best bank for opening a savings account in New York.” Creating FAQ pages that address common questions can also help capture voice search traffic.

Artificial Intelligence (AI) and Machine Learning

Artificial intelligence and machine learning are revolutionizing SEO by providing deeper insights and more precise targeting. For local banks, AI can analyze vast amounts of data to identify patterns and trends that can inform geofencing and SEO strategies.

Machine learning algorithms can predict customer behavior and preferences, allowing banks to deliver more personalized and relevant content.

AI-powered chatbots and virtual assistants can enhance customer service by providing instant responses to inquiries and guiding users through various banking processes.

These tools can be integrated with geofencing technology to offer location-based assistance. For instance, a chatbot could provide information about the nearest ATM or branch based on the user’s location.

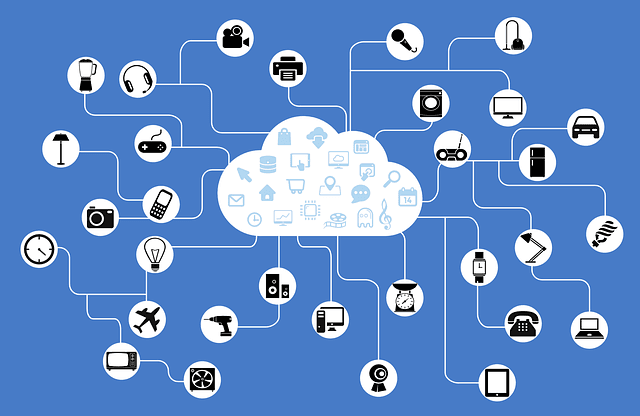

Internet of Things (IoT)

The Internet of Things (IoT) connects everyday devices to the internet, creating a network of interconnected smart devices. For local banks, IoT offers opportunities to enhance customer experiences and improve local SEO.

IoT devices, such as smart ATMs and connected signage, can provide real-time information and personalized services to customers.

Geofencing can be integrated with IoT devices to trigger actions based on the user’s location. For example, a smart ATM could send a notification to a customer walking by, informing them of its availability and features. This real-time interaction can drive more foot traffic to physical locations and improve customer engagement.

Blockchain Technology

Blockchain technology is gaining traction in the financial industry due to its potential to enhance security and transparency. For local banks, integrating blockchain can build trust with customers and improve SEO by showcasing a commitment to cutting-edge technology.

Blockchain can also streamline processes such as identity verification and transaction tracking, improving overall efficiency.

By highlighting the use of blockchain technology in their marketing and content strategies, banks can attract tech-savvy customers and improve their online reputation. This can lead to more positive reviews and higher search engine rankings.

Hyper-Personalization

Hyper-personalization takes personalization to the next level by using real-time data and advanced analytics to deliver highly tailored experiences. For local banks, hyper-personalization can involve using geofencing to send individualized messages based on a customer’s location, behavior, and preferences.

For example, if a customer frequently visits a particular coffee shop, the bank could send a notification offering a discount on purchases made with their bank card at that location. This level of personalization can significantly enhance customer satisfaction and loyalty, leading to increased engagement and better SEO performance.

5G Technology

The rollout of 5G technology promises faster internet speeds and lower latency, which can greatly enhance geofencing and local SEO efforts. With 5G, banks can deliver richer, more interactive content to mobile users in real-time. This includes high-quality videos, augmented reality experiences, and instant notifications.

Faster connectivity also means that mobile users will have a better experience when interacting with a bank’s website or app, leading to higher engagement and lower bounce rates. As a result, banks can improve their search engine rankings and attract more local customers.

Ethical SEO and Data Privacy

As consumers become more aware of data privacy issues, ethical SEO practices are becoming increasingly important. Banks must ensure that their geofencing and SEO strategies comply with data protection regulations such as GDPR and CCPA. Being transparent about data collection and usage can build trust with customers and improve online reputation.

Banks should provide clear opt-in and opt-out options for geofencing notifications and ensure that customer data is stored securely. By prioritizing data privacy and ethical SEO practices, banks can foster customer trust and loyalty, which can positively impact their search engine rankings.

Sustainable and Socially Responsible Practices

Sustainability and social responsibility are becoming key factors in consumer decision-making. Banks that demonstrate a commitment to environmental and social causes can attract more customers and improve their SEO. This can be achieved by creating content that highlights the bank’s sustainability initiatives, community involvement, and ethical practices.

Geofencing can be used to promote events and activities that align with these values, such as community clean-ups, charity drives, or educational workshops. Sharing these initiatives on social media and encouraging customers to participate can enhance the bank’s reputation and drive local engagement.

Implementing Future Trends in Geofencing and Local SEO

Augmented Reality (AR) and Virtual Reality (VR) in Banking

Example: Virtual Branch Tours

Imagine a local bank using AR to provide virtual tours of their branches. By integrating AR into their mobile app, users can use their smartphones to explore the bank’s facilities remotely.

This can be particularly useful for customers who are considering opening an account but want to get a feel for the branch before visiting. When customers approach a branch, the app can trigger an AR experience that overlays information about different services, such as loan options, savings accounts, and customer service desks.

Example: Remote Financial Consultations

Virtual reality can enable remote financial consultations, allowing customers to interact with financial advisors in a virtual environment. For example, a customer could wear a VR headset and join a virtual meeting with an advisor, discussing investment options or mortgage plans as if they were sitting together in the bank’s office.

This can make the consultation process more personal and engaging, especially for clients who cannot visit the branch in person.

Voice Search Optimization for Local Banks

Example: Voice-Activated Branch Locator

A local bank could optimize its website and mobile app for voice search by incorporating natural language queries. For instance, a voice-activated feature could allow users to find the nearest branch by simply asking, “Where is the closest [Bank Name] branch?”

The app could then provide directions, branch hours, and contact information. By integrating voice search capabilities, the bank can enhance user convenience and improve local search visibility.

Example: FAQ Content for Voice Search

Banks can create detailed FAQ sections on their websites, addressing common questions customers might ask using voice search. Questions like “How do I apply for a personal loan at [Bank Name]?” or “What are the mortgage rates at [Bank Name] in [City]?” should be answered clearly and concisely. This content can help the bank rank higher in voice search results and attract more local traffic.

Artificial Intelligence (AI) and Machine Learning in Geofencing

Example: Predictive Customer Engagement

AI and machine learning can be used to analyze customer behavior and predict future actions. For example, a bank could use machine learning algorithms to identify customers who are likely to be interested in a new savings account based on their past transactions and interactions.

Geofencing can then be used to send targeted notifications to these customers when they are near a branch, offering them a special promotion on the savings account.

Example: Personalized Marketing Campaigns

AI can also be used to create highly personalized marketing campaigns. By analyzing customer data, the bank can determine the best times and locations to send notifications.

For instance, if a customer frequently visits a particular shopping mall, the bank could send a notification about a credit card offer that provides extra rewards for purchases made at stores in that mall. This level of personalization can increase engagement and conversion rates.

Internet of Things (IoT) and Smart Banking

Example: Smart ATMs

Smart ATMs equipped with IoT sensors can offer enhanced services and connectivity. For example, a smart ATM can detect when a customer with the bank’s mobile app is nearby and send a notification about the ATM’s features, such as contactless transactions or cash deposit options. This can improve customer convenience and encourage the use of the bank’s ATMs.

Example: Connected Signage

Banks can use connected digital signage to display personalized messages to customers as they enter a branch. For instance, the signage could greet customers by name and provide information about their accounts or recent transactions. This creates a more personalized and engaging experience, enhancing customer satisfaction and loyalty.

Blockchain Technology in Banking

Example: Secure Identity Verification

Blockchain technology can be used to enhance the security of identity verification processes. For example, a bank could implement a blockchain-based system for verifying customer identities when they open new accounts or apply for loans. This system can provide a secure and transparent way to manage identity information, reducing the risk of fraud and enhancing customer trust.

Example: Transparent Transaction Tracking

Banks can use blockchain to provide customers with transparent and immutable records of their transactions. For instance, customers could access a blockchain-based ledger through the bank’s mobile app to view the details of their transactions, ensuring transparency and security. This can build trust and attract customers who prioritize data security.

Hyper-Personalization in Marketing

Example: Location-Based Offers

Using geofencing, banks can deliver hyper-personalized offers based on a customer’s location and behavior. For example, if a customer frequently visits a specific coffee shop, the bank could send a notification offering a discount on purchases made with their bank card at that shop. This targeted approach can increase customer engagement and loyalty.

Example: Behavioral Insights

Banks can use behavioral insights to tailor their marketing messages. For instance, if a customer regularly checks their account balance but rarely uses the mobile app’s other features, the bank could send a notification highlighting the benefits of those features, such as budget tracking or bill payments. By addressing the customer’s specific needs and behaviors, the bank can enhance the overall user experience.

5G Technology and Enhanced Connectivity

Example: Real-Time Notifications

With 5G technology, banks can deliver real-time notifications with minimal latency. For example, a bank could send instant alerts about suspicious account activity or upcoming loan payments, ensuring customers receive timely and relevant information. This can improve customer satisfaction and security.

Example: High-Quality Video Content

Banks can use 5G’s high-speed connectivity to deliver high-quality video content to mobile users. For example, they could create video tutorials on using mobile banking features or explain complex financial products in an engaging way. This content can be shared via geofencing notifications, attracting more customers and improving engagement.

Ethical SEO and Data Privacy Practices

Example: Transparent Data Usage Policies

Banks should implement transparent data usage policies that explain how customer data is collected, used, and protected. For instance, they could create a dedicated webpage detailing their data privacy practices and provide clear opt-in and opt-out options for geofencing notifications. This transparency can build trust and encourage customers to engage with the bank’s digital services.

Example: Compliance with Regulations

Ensuring compliance with data privacy regulations such as GDPR and CCPA is crucial. Banks can use geofencing to send notifications about updates to their privacy policies or new features that enhance data security. By prioritizing ethical SEO and data privacy, banks can maintain customer trust and improve their online reputation.

Sustainable and Socially Responsible Practices

Example: Promoting Green Initiatives

Banks can use geofencing to promote their sustainability initiatives and encourage community involvement. For example, they could send notifications about local tree planting events or offer incentives for customers who switch to paperless statements. Highlighting these efforts can attract environmentally conscious customers and improve the bank’s SEO.

Example: Community Engagement

Geofencing can be used to support community engagement efforts. For instance, a bank could send notifications about upcoming charity drives, educational workshops, or volunteer opportunities. Sharing these activities on social media and encouraging customer participation can enhance the bank’s reputation and drive local engagement.

Summary and Actionable Steps for Implementing Geofencing and SEO Strategies for Local Banks

Summary

Geofencing is a powerful technology that allows local banks to deliver targeted, location-based messages to customers, enhancing engagement and driving foot traffic to physical branches. By integrating geofencing with comprehensive SEO strategies, banks can significantly improve their online visibility and local search rankings.

This involves creating hyper-local content, optimizing for voice search, leveraging advanced technologies like AI and IoT, and adhering to ethical SEO practices. Future trends such as augmented reality, virtual reality, and 5G technology offer exciting new opportunities for banks to connect with customers and enhance their overall experience.

Actionable Steps

Step 1: Choose the Right Geofencing Platform

Select a geofencing platform that aligns with your bank’s objectives and integrates seamlessly with your existing systems. Ensure it supports the features you need, such as real-time notifications and detailed analytics.

Step 2: Define Geofence Boundaries

Identify strategic locations for setting up geofences, such as around your bank branches, ATMs, local shopping centers, and competitor banks. Determine the size and scope of each geofence based on your campaign goals.

Step 3: Develop Targeted Content

Create engaging, location-specific content that provides value to your customers. This could include special promotions, event notifications, and personalized offers. Ensure that the content is relevant and timely to increase engagement.

Step 4: Integrate Geofencing with Mobile Banking Apps

Work with app developers to integrate geofencing capabilities into your mobile banking app. Test the functionality thoroughly to ensure notifications are delivered accurately and promptly.

Step 5: Optimize for Voice Search

Adapt your SEO strategy to include natural language keywords and phrases commonly used in voice searches. Create detailed FAQ sections on your website to capture voice search traffic and improve local search visibility.

Step 6: Leverage AI and Machine Learning

Use AI and machine learning to analyze customer behavior and predict future actions. Implement predictive customer engagement strategies and personalized marketing campaigns based on these insights.

Step 7: Implement IoT and Smart Technologies

Deploy IoT devices, such as smart ATMs and connected signage, to enhance customer interactions and provide real-time information. Integrate these technologies with geofencing to offer personalized services.

Step 8: Utilize Blockchain for Security

Integrate blockchain technology to enhance the security and transparency of identity verification and transaction tracking processes. Highlight the use of blockchain in your marketing strategies to attract tech-savvy customers.

Step 9: Create Hyper-Local Content

Develop content that targets specific local communities and addresses their unique needs and interests. Use location-based keywords to improve local search rankings and attract relevant traffic.

Step 10: Engage with Local Influencers

Partner with local influencers to promote your bank’s services and geofencing campaigns. Leverage their reach and credibility to generate high-quality backlinks and social media engagement.

Step 11: Monitor and Analyze Performance

Regularly track and analyze performance metrics to assess the effectiveness of your geofencing and SEO strategies. Use tools like Google Analytics, Google Search Console, and social media analytics to gather insights and make data-driven adjustments.

Step 12: Prioritize Ethical SEO and Data Privacy

Ensure compliance with data privacy regulations and maintain transparency about how customer data is collected and used. Provide clear opt-in and opt-out options for geofencing notifications to build trust and encourage customer engagement.

Step 13: Promote Sustainability and Community Engagement

Use geofencing to highlight your bank’s sustainability initiatives and community involvement. Promote green initiatives, charity drives, and volunteer opportunities to attract environmentally conscious customers and improve your local reputation.

Step 14: Embrace Future Technologies

Stay ahead of emerging trends by exploring the potential of augmented reality, virtual reality, and 5G technology. Implement these technologies to create immersive, engaging experiences that attract and retain customers.

By following these actionable steps, local banks can effectively implement geofencing and SEO strategies to enhance customer engagement, drive foot traffic, and improve their local search rankings. Embracing future trends and technologies will further position them as innovative leaders in the financial industry, capable of meeting the evolving needs of their customers.

Conclusion

Geofencing offers local banks a powerful tool to deliver targeted, location-based messages, enhancing customer engagement and driving foot traffic to branches. By integrating geofencing with comprehensive SEO strategies, banks can improve online visibility and local search rankings. This involves creating hyper-local content, optimizing for voice search, leveraging AI and IoT technologies, and adhering to ethical SEO practices.

Future trends such as augmented reality, virtual reality, and 5G technology present exciting opportunities to connect with customers in innovative ways. By implementing these strategies and staying ahead of emerging trends, local banks can significantly enhance their customer experience, build stronger community connections, and position themselves as leaders in the financial industry. Embracing these advancements ensures they meet evolving customer needs and maintain a competitive edge.

READ NEXT:

- Earning Backlinks through Scholarship Programs

- The Role of Video Content in B2C SEO

- How to Use Paid Advertising for Lead Generation

- On-Page SEO Essentials for Educational Websites

- 21 Best Ad Campaign Management Tools: Our Take

Comments are closed.