In the fast-paced world of FinTech, the blend of finance and technology has not only revolutionized traditional financial services but also opened a plethora of opportunities for startups. However, navigating the journey of forming a FinTech company involves threading through a maze of regulatory requirements, technological challenges, and market demands. This guide aims to demystify the process of company formation for FinTech startups, providing a clear, step-by-step pathway from conception to launch. With a focus on the unique landscape of the FinTech sector, this guide will serve as your compass, ensuring that your innovative financial solutions reach the market efficiently and effectively.

Understanding the FinTech Landscape: A Comparative Overview

Before diving into the company formation process, it’s crucial to understand what sets FinTech startups apart from other tech-based ventures. The FinTech industry stands at the intersection of financial services and cutting-edge technology, offering solutions that aim to enhance, automate, and democratize financial services. This dual nature of FinTech startups—serving as both technology and financial entities—imposes a unique set of challenges and opportunities.

Regulatory Environment: Unlike other technology sectors where product launch can be relatively straightforward, FinTech startups navigate a complex regulatory landscape. Financial services are among the most heavily regulated sectors, necessitating a thorough understanding of both national and international financial regulations, such as anti-money laundering (AML) laws, the General Data Protection Regulation (GDPR) for handling customer data, and specific regulations governing financial transactions and services.

Innovation vs. Trust: FinTech startups operate on the cutting edge of technology, incorporating advancements like blockchain, artificial intelligence (AI), and big data analytics to redefine financial services. However, innovation must be balanced with building trust among users who demand not just convenience but also security and reliability in their financial transactions. Establishing this trust requires a meticulous approach to security, privacy, and user experience, distinguishing FinTech startups from other tech ventures that may not face the same level of scrutiny.

Funding and Investment: The financial aspect of FinTech startups also influences their approach to funding and investment. While tech startups might prioritize rapid growth and user acquisition, FinTech startups must also consider the capital requirements for regulatory compliance, secure infrastructure, and possibly, a longer runway to market due to the intricate nature of financial services. This necessitates a strategic approach to securing investment, with a clear plan for navigating regulatory hurdles and achieving market readiness.

Partnerships and Ecosystem Integration: Finally, the success of a FinTech startup often hinges on its ability to integrate into the broader financial ecosystem. This includes forming strategic partnerships with traditional banks, payment networks, and other financial institutions. Such collaborations can provide the necessary infrastructure, credibility, and market access essential for a FinTech startup’s growth but require careful negotiation and alignment of interests.

Navigating the FinTech landscape requires a nuanced understanding of these unique challenges and opportunities. As we delve into the specifics of company formation for FinTech startups, keep these distinguishing factors in mind. They not only frame the journey ahead but also underscore the importance of strategic planning, regulatory compliance, and ecosystem integration in the successful launch and scaling of a FinTech venture.

Step 1: Navigating Regulatory Compliance

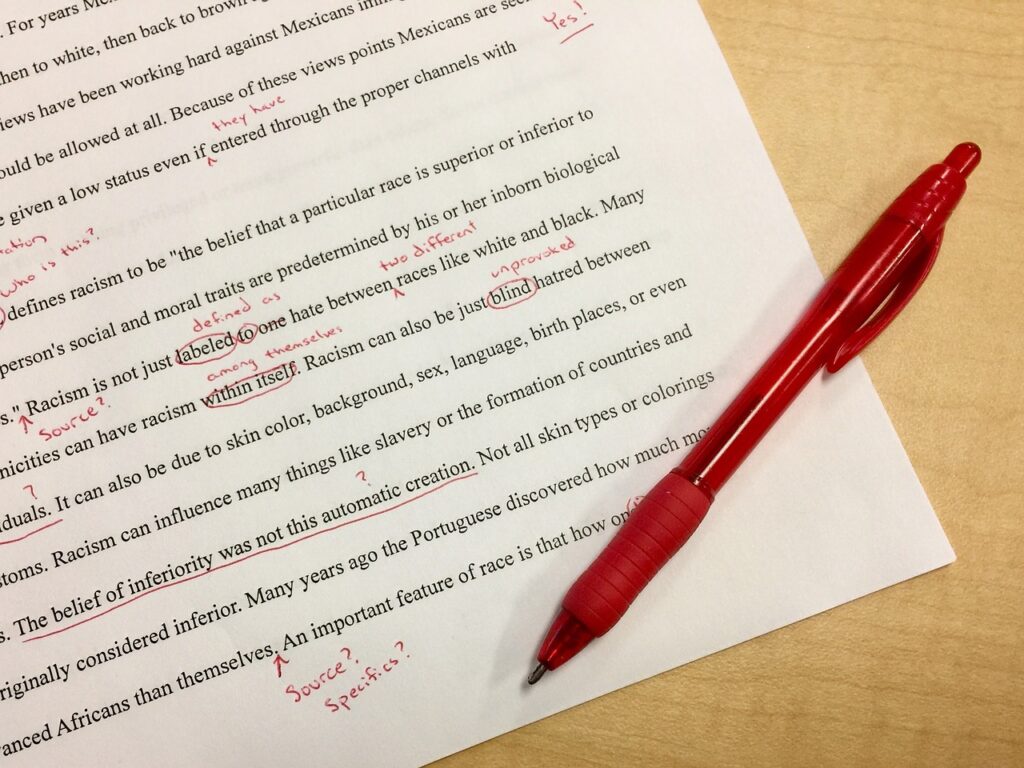

The first and perhaps most daunting hurdle for FinTech startups is regulatory compliance. Operating in the financial sector means adhering to a stringent regulatory framework designed to protect consumers and ensure the integrity of the financial system. Achieving and maintaining compliance not only ensures legal and operational integrity but also builds trust with customers and stakeholders, a crucial asset in the financial technology sector. Here, we delve deeper into strategies for effectively managing regulatory compliance, emphasizing the importance of a proactive, informed, and strategic approach.

Establishing a Proactive Compliance Framework

Creating a compliance framework from the outset that anticipates both current and future regulatory requirements is essential. This framework should be designed to adapt to the rapidly evolving FinTech regulatory landscape, ensuring your startup remains compliant as it scales and as regulations change.

Comprehensive Risk Assessment: Begin with a thorough risk assessment to identify all regulatory obligations relevant to your FinTech model. This includes understanding the nuances of the markets you plan to enter and the specific financial services you intend to offer. A risk-based approach allows you to prioritize compliance efforts based on potential impact, directing resources more effectively.

Regulatory Mapping: Develop a regulatory map that outlines all applicable regulations, the authorities that enforce them, and the timelines for compliance. This map should be a living document, regularly updated to reflect changes in the regulatory landscape. It acts as a roadmap for your compliance journey, ensuring no regulatory requirement is overlooked.

Integrating Compliance into Product Development

For FinTech startups, integrating compliance into the product development process is not just about adding a layer of security; it’s about embedding regulatory considerations into the DNA of your products and services.

Regulatory Design Thinking: Adopt a regulatory design thinking approach, where compliance considerations are integrated into the product design phase. This involves collaboration between your product development, legal, and compliance teams to ensure that products are not only innovative but also built to comply with regulatory standards from the ground up.

Technology-Driven Compliance Solutions: Leverage technology to automate and manage compliance processes. Regulatory technology (RegTech) solutions can streamline compliance reporting, monitor transactions for suspicious activities, and automate customer due diligence processes. Investing in RegTech not only improves efficiency but also enhances the accuracy and reliability of your compliance efforts.

Building Relationships with Regulators

Engaging with regulatory bodies is a strategic move that can offer insights, facilitate compliance, and even open doors to regulatory innovation. Building a positive and proactive relationship with regulators can position your startup as a compliant and responsible player in the FinTech ecosystem.

Early and Ongoing Engagement: Initiate dialogue with regulatory bodies early in your startup’s journey. Seek guidance on compliance matters, and keep regulators informed about your products and innovations. Regular engagement can lead to a better understanding of regulatory expectations and provide early warnings about potential compliance issues.

Participation in Regulatory Sandbox Programs: Many regulatory authorities offer sandbox programs that allow FinTech startups to test their innovations in a controlled environment with real consumers, under regulatory supervision. Participating in these programs can provide valuable feedback on compliance requirements and help fine-tune your offerings before full-scale launch.

Cultivating a Culture of Compliance

Fostering a company culture that values and prioritizes regulatory compliance is fundamental. Compliance should be viewed not as a hindrance but as a critical component of your business model that enhances trustworthiness and market competitiveness.

Compliance Training and Awareness: Implement regular training programs for all employees to ensure they understand the regulatory environment, the importance of compliance, and their role in maintaining it. A well-informed team is your first line of defense against compliance breaches.

Leadership in Compliance: Set an example from the top, with leadership actively promoting the importance of regulatory compliance. When leadership prioritizes compliance, it permeates throughout the organization, establishing a strong foundation for ethical and compliant business practices.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Step 2: Establishing Your Technological Infrastructure

The backbone of any FinTech startup is its technology. Developing a secure, scalable, and user-friendly platform is crucial for delivering your financial services effectively. It’s important to recognize that in the FinTech world, technology is not just a tool but the very backbone of your operation. The right technological framework can empower your FinTech startup to deliver exceptional service, maintain security and compliance, and scale seamlessly in a competitive landscape. Let’s explore the expanded dimensions of building a robust technological infrastructure that supports your FinTech startup’s aspirations and operational needs.

Prioritizing Security from the Start

In the FinTech sector, where startups handle sensitive financial data, prioritizing security from the outset is not optional—it’s essential. Implementing a security-first approach in developing your technological infrastructure can protect your business from potential threats and build trust with your users.

Advanced Encryption Techniques: Employ state-of-the-art encryption methods to secure data transmission and storage. Consider implementing end-to-end encryption for all user data exchanges and utilizing secure algorithms for data at rest. Encryption should be your data’s first line of defense, safeguarding information even in the event of a breach.

Regular Security Audits and Penetration Testing: Schedule regular security audits and penetration testing conducted by external experts. These practices help identify vulnerabilities in your system before they can be exploited by malicious actors. Incorporating these checks into your development cycle ensures ongoing vigilance against emerging security threats.

Building Scalable and Flexible Architectures

For FinTech startups, the ability to scale operations efficiently is critical to accommodate growth and adapt to changing market demands. Designing your technological infrastructure with scalability and flexibility in mind allows you to expand your services without overhauling your entire system.

Microservices Architecture: Adopt a microservices architecture where your application is structured as a collection of loosely coupled services. This approach allows for easier scaling, as individual services can be updated, deployed, and scaled independently, enabling your FinTech startup to adapt quickly to new opportunities or user demands.

Cloud Computing Solutions: Leverage cloud computing platforms for their scalability, flexibility, and cost-effectiveness. Cloud solutions can adapt to your startup’s growth, allowing for rapid deployment of new features and services. Opt for providers that offer strong security measures, compliance certifications, and financial industry experience.

Integrating Compliance into Technology

For FinTech startups, regulatory compliance must be woven into the technological infrastructure. This integration ensures that compliance is maintained as an integral part of your operations, not just an afterthought or a box-checking exercise.

Automated Compliance Tools: Utilize RegTech solutions for automating compliance-related tasks, such as transaction monitoring, risk management, and reporting. Automation can significantly reduce the manual workload associated with compliance activities, minimize human error, and ensure timely adherence to regulatory requirements.

Data Governance Frameworks: Implement robust data governance frameworks that define how data is collected, stored, processed, and shared. These frameworks should be designed to comply with financial regulations, data protection laws, and any sector-specific guidelines. Effective data governance supports compliance, enhances data security, and builds trust with users and regulators.

Fostering an Agile Development Environment

In the rapidly evolving FinTech landscape, being able to iterate and innovate quickly gives startups a competitive edge. Fostering an agile development environment supports continuous improvement, allowing your technology team to respond swiftly to feedback, market trends, or regulatory changes.

Continuous Integration and Continuous Deployment (CI/CD): Adopt CI/CD practices to automate the software release process, enabling frequent and reliable code changes. This methodology allows for rapid testing, iteration, and deployment of new features, keeping your platform at the cutting edge of FinTech innovation.

Feedback Loops and User-Centric Design: Establish mechanisms for gathering and incorporating user feedback into the development process. Engaging with your user base and prioritizing a user-centric design ensures that your platform remains relevant, accessible, and aligned with customer needs.

Step 3: Securing Funding

FinTech startups often require significant upfront investment to cover technology development, regulatory compliance, and market entry costs. Securing this funding requires a clear strategy and a compelling pitch to potential investors. The right funding strategy can provide not just the financial runway needed for growth but also valuable partnerships, market credibility, and strategic guidance. Let’s explore sophisticated strategies for securing funding that aligns with your FinTech startup’s long-term vision and operational needs.

Crafting a Narrative That Resonates with FinTech Investors

Investors in the FinTech space are looking for more than just innovative ideas; they seek startups with the potential to disrupt financial markets, address unmet needs, and offer scalable solutions. Creating a compelling narrative that highlights your startup’s unique value proposition, market potential, and competitive advantage is crucial.

Highlighting the Problem-Solution Fit: Clearly articulate the specific financial problem your startup aims to solve and how your solution addresses this problem more effectively than existing alternatives. Use data and market research to back up your claims, demonstrating a deep understanding of your target market and customer pain points.

Demonstrating Technological and Regulatory Expertise: Given the complex regulatory landscape of the financial sector, showcasing your team’s expertise in navigating these challenges can significantly boost investor confidence. Highlight any proprietary technology, patent-pending solutions, or unique compliance frameworks you’ve developed as key differentiators.

Leveraging Non-Traditional Funding Sources

While venture capital remains a primary source of funding for FinTech startups, exploring non-traditional funding avenues can uncover opportunities that offer both capital and strategic benefits.

Strategic Partnerships and Corporate Venture Capital (CVC): Engaging with established financial institutions and corporations through strategic partnerships or CVC initiatives can provide funding while also offering access to industry expertise, customer bases, and operational resources. These partnerships often come with strategic support that can accelerate your startup’s growth and market penetration.

Government Grants and Innovation Funds: Many governments and international bodies offer grants and innovation funds aimed at supporting FinTech innovation, especially in areas like financial inclusion, cybersecurity, and blockchain. These grants can provide non-dilutive funding and validation for your startup, though they often come with specific project requirements and reporting obligations.

Engaging with FinTech Accelerators and Incubators

Participation in FinTech-focused accelerators and incubators can offer much more than initial seed funding. These programs provide mentorship, industry connections, and exposure to potential investors through demo days and networking events.

Choosing the Right Program: Research and apply to accelerators and incubators that align with your startup’s focus area and offer the specific resources, mentorship, and investor networks that can benefit your business. Look for programs with a strong track record of supporting FinTech startups and facilitating successful fundraising rounds.

Maximizing the Experience: Engage actively with mentors, participate in workshops and training sessions, and use the opportunity to refine your business model, pitch, and product. The feedback and connections gained through these programs can be invaluable for future fundraising efforts.

Preparing for the Due Diligence Process

Investors in the FinTech sector conduct rigorous due diligence, given the regulatory complexities and technological risks involved. Preparing thoroughly for this process can streamline fundraising efforts and demonstrate your startup’s professionalism and readiness.

Comprehensive Documentation: Ensure all legal, financial, and business documents are in order, including incorporation papers, financial projections, regulatory compliance records, IP documentation, and any contracts or agreements. Having these documents organized and readily available can expedite the due diligence process.

Transparent Financial Modeling: Develop detailed financial models that clearly outline your use of funds, revenue projections, and growth strategy. Be prepared to discuss your assumptions and how you plan to achieve profitability, addressing potential investor concerns around customer acquisition costs, lifetime value, and scalability.

Securing funding for a FinTech startup requires a thoughtful approach that extends beyond traditional pitches to venture capitalists. By crafting a compelling narrative, exploring non-traditional funding sources, engaging with accelerators and incubators, and meticulously preparing for due diligence, FinTech entrepreneurs can secure the capital and strategic partnerships necessary to propel their startups forward in the competitive financial technology landscape.

Step 4: Making a Successful Market Entry

Making a successful market entry is a defining moment for FinTech startups. It’s the culmination of meticulous planning, development, and strategizing, translating into your first real test in the marketplace. A successful market entry not only establishes your presence but also sets the tone for future growth and scalability. Let’s delve into a more nuanced strategy for ensuring your FinTech startup not only enters the market but does so with a splash, creating lasting impressions and immediate value.

Establishing Market Fit and Understanding Customer Needs

Before you can successfully enter the market, you must ensure your product or service fills a genuine need or solves a real problem. This requires going beyond surface-level market research to deeply understand your potential customers’ behaviors, preferences, and pain points.

Conducting In-Depth Market Research: Utilize both quantitative and qualitative research methods to gather insights about your target market. This could include surveys, focus groups, and in-depth interviews with potential users. Leveraging analytics tools to understand online behaviors and preferences can also provide valuable insights.

Pilot Programs and Beta Testing: Launching a pilot program or beta version of your product can offer real-world feedback on its usability, features, and overall market fit. This feedback loop is invaluable for making necessary adjustments before a full-scale launch, ensuring that your product meets customer expectations right out of the gate.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Strategic Pricing and Value Proposition

In the competitive FinTech sector, how you price your product and articulate your value proposition can significantly impact your market entry success. Your pricing strategy should not only reflect the value you provide but also consider market standards and customer sensitivity.

Competitive Pricing Analysis: Analyze your competitors’ pricing structures to ensure your pricing is competitive yet reflects the value and innovation of your offering. Consider employing psychological pricing strategies to make your product more appealing.

Clear and Compelling Value Proposition: Your value proposition should succinctly communicate the unique benefits your FinTech solution offers. It should clearly differentiate your product from existing solutions, emphasizing its advantages and the specific problems it solves.

Building Brand Awareness and Trust

For FinTech startups, building brand awareness and trust from the outset is crucial. The financial sector’s sensitive nature means customers need to feel confident in your ability to securely manage their financial information and transactions.

Leveraging Content Marketing: Develop and distribute high-quality, informative content that addresses your target audience’s needs and concerns. This could include blog posts, whitepapers, and videos that provide financial tips, explainers on how your product works, and insights into industry trends.

Utilizing Social Proof: Social proof, such as testimonials from beta testers, endorsements from industry experts, and case studies, can significantly boost trust in your brand. Displaying seals of approval from regulatory bodies or certifications can also reassure customers about your commitment to security and compliance.

Engaging in Strategic Partnerships

Forming strategic partnerships with established players in the financial sector can provide a critical boost to your market entry strategy. These partnerships can offer credibility, access to a broader customer base, and valuable resources.

Partnership with Financial Institutions: Collaborating with traditional banks or financial institutions can offer mutual benefits. For the institutions, it provides a way to offer innovative solutions to their customers. For FinTech startups, it offers legitimacy and access to established customer bases.

Collaboration with Non-Financial Partners: Consider partnerships outside the traditional financial sector that can offer new channels for your services. This could include e-commerce platforms, telecommunications companies, or even educational institutions, broadening your reach and market impact.

Beyond the Foundational Steps

Beyond the foundational steps of regulatory compliance, establishing technological infrastructure, securing funding, and making a successful market entry, there are additional critical steps that FinTech startups should consider to solidify their presence and ensure long-term success in the market.

Building a Strong Brand Identity

In the crowded FinTech space, establishing a strong, recognizable brand that resonates with your target audience is crucial. Your brand is not just your logo or color scheme; it’s the entire experience you offer your customers, from the first point of contact to ongoing engagement.

Developing a Unique Value Proposition (UVP): Clearly define what sets your FinTech startup apart from competitors. Your UVP should focus on the specific benefits your solution offers, such as better security, lower fees, or an innovative approach to traditional financial services.

Consistent Brand Messaging: Ensure that your brand messaging is consistent across all platforms and communications. This includes your website, social media, marketing materials, and customer service. Consistency helps build trust and recognition, making it easier for customers to understand and remember your brand.

Leveraging Data Analytics

In the digital-first world of FinTech, leveraging data analytics can provide invaluable insights into customer behavior, market trends, and operational efficiencies. Data-driven decision-making can significantly enhance your product offering, customer satisfaction, and strategic planning.

Implementing Analytics Tools: Use analytics tools to track user interactions with your platform, identify popular features, and pinpoint areas for improvement. This data can inform everything from user interface design to new feature development.

Personalization and Customer Insights: Analyze customer data to offer personalized services, recommendations, and support. Personalization can improve customer engagement and loyalty, setting your FinTech startup apart from competitors.

Focusing on Customer Support and Education

The FinTech sector often introduces new and complex technologies that can be daunting for users. Providing robust customer support and educational resources can help demystify these technologies, fostering trust and confidence in your services.

Comprehensive Support Channels: Offer multiple channels for customer support, including live chat, email, phone support, and FAQs. Ensure your support team is knowledgeable and equipped to handle inquiries related to both your technology and the financial services you provide.

Educational Content: Create and distribute educational content that helps users understand your services, the technology behind them, and best practices for managing their finances. This could include tutorials, webinars, blog posts, and instructional videos.

Prioritizing Regulatory Innovation and Advocacy

As a FinTech startup, staying ahead of regulatory changes and actively participating in industry discussions can position your company as a leader in regulatory innovation.

Engagement with Regulatory Bodies: Build relationships with regulators and participate in consultations on proposed regulatory changes. This engagement can provide early insights into regulatory trends and offer opportunities to influence policy in ways that support innovation.

Industry Collaboration on Best Practices: Collaborate with other FinTech companies and industry associations to develop and advocate for best practices in regulatory compliance, customer protection, and technological standards. Collective action can lead to more favorable regulatory environments and advance the industry as a whole.

RapidFormations is an invaluable resource for entrepreneurs who seek a fast and efficient way to establish their business in the UK. Their streamlined process simplifies the complexities of company registration, especially for overseas clients. With RapidFormations, you can ensure that your business not only complies with UK laws but is also set up for success from day one. Whether you’re expanding into the UK market or starting fresh, their expertise will guide you through every step of the formation process. Try it out now!

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence.

Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations.

Conclusion

Embarking on the journey of launching a FinTech startup is both an exciting and formidable venture. It requires navigating the complexities of regulatory compliance, building a solid technological infrastructure, securing vital funding, and making a successful entry into a competitive market. This guide has aimed to illuminate the path from concept to launch, providing FinTech entrepreneurs with a roadmap to navigate the intricate landscape of financial technology.

In conclusion, the formation and growth of a FinTech startup demand a blend of innovation, strategic planning, and perseverance. By thoroughly understanding and addressing regulatory requirements, leveraging cutting-edge technology to build secure and scalable solutions, crafting compelling narratives to attract investment, and strategically positioning your product in the market, your startup can not only survive but thrive. Remember, the key to success in the FinTech arena lies in continuously adapting to the rapidly evolving financial and technological landscapes, always with an eye towards solving real-world problems and enhancing the financial well-being of your users. With these guiding principles, your FinTech startup is well-equipped to make a significant impact in the dynamic world of financial technology.

Next Read

- A Guide to Company Formation for Creative Industries in the UK

- How to Navigate UK’s Company Formation Process for Foreign Investors

- The Evolution of Company Formation: From Paperwork to Digital Solutions

- Maximizing the Benefits of Your Company Formation Service

- Critical Legal Considerations for Company Formation in the UK

Comments are closed.