Understanding Financial Marketing Tools

When it comes to mastering financial marketing, understanding the right tools can make a significant difference. In this section, I will discuss the importance of fintech in marketing and some innovative fintech solutions that have transformed how financial businesses operate.

Importance of Fintech in Marketing

Fintech, or financial technology, plays a crucial role in modern marketing strategies. Nearly two-thirds of consumers use at least two or more fintech services, integrating them into their daily lives (Investopedia). The integration of fintech in marketing offers several benefits:

- Enhanced Customer Experience: Fintech solutions streamline processes, making transactions faster and more efficient, thereby improving customer satisfaction.

- Data-Driven Decisions: Fintech tools provide valuable insights through data analytics, allowing businesses to make informed marketing decisions.

- Access to Underserved Markets: Fintech startups often serve populations that traditional financial services overlook, offering opportunities for market expansion (Investopedia).

For a deeper dive into how fintech is reshaping the financial industry, visit our section on finance industry marketing.

Innovative Fintech Solutions

Several innovative fintech solutions have emerged, providing cutting-edge tools for financial marketing. Here are a few noteworthy examples:

Affirm: This company offers an alternative to traditional credit cards by providing immediate short-term loans for online purchases. Affirm targets consumers with poor or no credit, helping them build credit history while making purchases (Investopedia).

Robinhood: A pioneer in commission-free trading, Robinhood has revolutionized the brokerage industry by making it easier for the average person to invest in stocks and cryptocurrencies. This has attracted a younger demographic, broadening the market for investment services.

Kabbage: An online financial technology company that provides funding directly to small businesses, utilizing data analytics to streamline the loan application process. This service reaches businesses faster than traditional banks, making it a popular choice among small business owners.

| Fintech Solution | Key Feature | Target Audience |

|---|---|---|

| Affirm | Immediate short-term loans | Consumers with poor/no credit |

| Robinhood | Commission-free trading | Young investors |

| Kabbage | Fast funding for small businesses | Small business owners |

To learn more about effective digital tools in financial marketing, check out our article on digital finance marketing.

Understanding and leveraging these fintech tools can significantly enhance your financial marketing efforts. For strategies on leveraging these tools, view our insights on finance marketing strategies. Fintech is not only about technology but transforming how businesses engage with their customers, making it an essential component of any successful financial marketing strategy.

Key Performance Indicators in Marketing

Defining KPIs for Financial Marketing

In financial marketing, key performance indicators (KPIs) are essential for measuring the effectiveness of your campaigns. KPIs help gauge the success of different strategies and ensure that your marketing efforts align with your business goals. Here, I’ll break down some critical KPIs every finance business owner, CEO, and marketing executive should consider.

Analyzing Click-Through Rate (CTR)

Click-through rate (CTR) is a crucial KPI that indicates how often people click on your ads after seeing them. A high CTR usually signifies that your content is relevant and appealing to your target audience. For search ads, the average CTR is approximately 6.6 percent, while for display ads, it is around 0.6 percent (Harvard Business School Online).

| Ad Type | Average CTR |

|---|---|

| Search | 6.6% |

| Display | 0.6% |

By monitoring and optimizing your CTR, you can refine your marketing strategies and improve overall engagement.

Understanding Cost per Click (CPC)

Cost per click (CPC) is another vital KPI, particularly for online advertising. CPC is calculated by dividing the total ad cost by the number of clicks it receives. For example, if you spend $100 on an ad that garners 50 clicks, your CPC would be $2 (Harvard Business School Online).

| Total Ad Cost | Number of Clicks | CPC |

|---|---|---|

| $100 | 50 | $2 |

Understanding your CPC allows you to manage your advertising budget more effectively and ensures optimal allocation of resources. Proper budgeting is further explored in our section on the importance of marketing budget.

Evaluating Conversion Rate

Conversion rate is a pivotal KPI that measures the percentage of visitors who complete a desired action on your website. This could be anything from filling out a form to making a purchase. The conversion rate is calculated by dividing the number of conversions by the total number of visitors and multiplying that figure by 100 (Harvard Business School Online).

| Number of Conversions | Total Visitors | Conversion Rate |

|---|---|---|

| 50 | 1,000 | 5% |

Regularly evaluating your conversion rate helps you to understand how effective your marketing efforts are in driving desired actions. If you notice a low conversion rate, it might be time to reassess your finance marketing strategies and implement new tactics that resonate better with your audience.

Understanding these KPIs can significantly enhance your approach to financial marketing tools. Each metric provides insights that help to refine strategies, improve resource allocation, and optimize overall performance. For more in-depth analysis, consider exploring tools like HubSpot Email Marketing and Ahrefs for Competitive Analysis.

Effective Marketing Strategies

With a focus on financial marketing tools, it’s vital to implement effective marketing strategies. Here, I’ll outline some key aspects that have proven successful in my experience.

Market Research Insights

Understanding consumer behavior is crucial. Market research helps identify what matters most to clients and how to stand out from competitors. This effort identifies untapped audiences and formulates a plan to reach them, enhancing sales and improving the bottom line (Investopedia).

| Research Method | Purpose | Tools |

|---|---|---|

| Surveys | Gather direct feedback | Google Forms, SurveyMonkey |

| Focus Groups | Deep insights from a small group | Dovetail, Recollective |

| Data Analysis | Identify trends and patterns | Google Analytics, Tableau |

Building a Sustainable Brand

Creating a sustainable brand involves communicating a competitive advantage over rivals. This means understanding customer needs and crafting marketing assets that convey the company’s core value proposition (Investopedia). This can be achieved through consistent messaging, quality customer service, and engaging finance content marketing.

Setting Short-term Goals

Although sales are the ultimate target, setting short-term goals creates measurable benchmarks. Goals like increasing brand awareness, gaining market share, or launching a new product provide clear markers for progress (Investopedia).

| Goal | Objective | Metric |

|---|---|---|

| Brand Awareness | Increase brand recognition | Social Media Engagement, Impressions |

| Market Share | Capture a larger portion of market | Sales Volume, Market Position |

| Product Launch | Successfully introduce new product | Initial Sales, Customer Feedback |

Developing a Customer Profile

Understanding your audience is paramount. Developing customer profiles or personas helps in delivering tailored marketing messages. This involves gathering demographic data, buying behaviors, and customer preferences.

| Demographic | Information | Data Source |

|---|---|---|

| Age | Target age range | Surveys, CRM Data |

| Income | Customer income levels | Market Research Reports |

| Buying Behavior | Purchase patterns | Sales Data, Website Analytics |

Focusing on these effective marketing strategies can significantly impact the success of your financial marketing efforts. Always prioritize understanding your clients and crafting strategies that resonate with them. For in-depth strategies, refer to our comprehensive guide on finance marketing strategies.

Budgeting in Financial Marketing

Importance of Marketing Budget

In financial marketing, having a well-planned budget is crucial. A marketing budget outlines the expenditure for various marketing activities, ensuring that spending is aligned with the company’s overall financial capabilities. A marketing budget is critical in determining whether the cost associated with marketing initiatives will help the company break even and generate profits. As highlighted by the Corporate Finance Institute, a well-structured budget is essential for balancing expenditures with what the organization can afford.

In my experience, a comprehensive marketing budget allows financial businesses to strategically allocate resources, evaluate the effectiveness of marketing campaigns, and make necessary adjustments to maximize return on investment.

Components of the Marketing Budget

A marketing budget consists of several key components that collectively support the marketing objectives of a financial business. Here are the essential components:

1. Revenue and Cost Estimates:

The budget should include revenue forecasts and cost estimates based on planned marketing activities. This includes expected product volume and pricing, production costs, delivery expenses, and operating and financing costs. Accurate estimates help in anticipating financial outcomes and optimizing resource allocation.

2. Marketing Channels and Tools:

Allocating funds across various marketing channels—such as social media, email marketing, content marketing, and paid advertising—is essential. Utilizing effective financial marketing tools like Sprout Social for Social Media Management, HubSpot Email Marketing, and Unbounce for Landing Page Creation can enhance campaign performance.

| Marketing Channel | Budget Allocation ($) |

|---|---|

| Social Media Advertising | 5,000 |

| Email Marketing | 3,000 |

| Content Marketing | 4,000 |

| Paid Advertising (PPC) | 6,000 |

| Influencer Marketing | 2,000 |

3. Personnel and Administrative Costs:

Include salaries, benefits, and administrative costs associated with marketing staff. Having a skilled team to manage and execute marketing campaigns is crucial for achieving desired outcomes. For more on building a sustainable marketing strategy, explore finance marketing strategies.

4. Analytical Tools and Software:

Investing in analytics tools for tracking key metrics such as CTR, CPC, and ROI is vital. Tools like Ahrefs for Competitive Analysis and Google Analytics can provide valuable insights into campaign performance.

5. Contingency Funds:

Allocating a contingency fund for unforeseen expenses ensures that the marketing campaign can adapt to unexpected changes without disrupting overall financial plans.

| Budget Component | Estimated Cost ($) |

|---|---|

| Revenue and Cost Estimates | 3,000 |

| Marketing Channels and Tools | 20,000 |

| Personnel and Administrative Costs | 7,000 |

| Analytical Tools and Software | 2,000 |

| Contingency Funds | 1,000 |

Creating a robust marketing budget can significantly impact the success of your financial marketing efforts. By strategically planning and allocating resources, you can drive growth and achieve a high return on investment. For more insights into effective budgeting strategies, visit our section on financial services marketing.

Leveraging Digital Marketing Tools

As a financial marketer, having the right tools at your disposal can make a significant difference in reaching and engaging with your target audience. Here are some of my top picks for essential financial marketing tools:

Sprout Social for Social Media Management

Sprout Social is an all-in-one social media management platform that I rely on heavily. It helps me organize content calendars, schedule and publish posts across multiple social media platforms, and analyze the performance of my social campaigns. This tool also simplifies collaboration with colleagues and clients, ensuring that our social media strategies are cohesive and effective.

Key Features of Sprout Social:

- Content calendar management

- Multi-platform publishing and scheduling

- Social analytics tracking

- Collaboration tools

| Feature | Benefits |

|---|---|

| Content Calendar | Easily organize and schedule posts |

| Multi-Platform Publishing | Reach a wider audience |

| Social Analytics | Measure performance and adjust strategies |

| Collaboration | Streamline teamwork efforts |

For more insights on digital finance marketing, check out our detailed guide.

HubSpot Email Marketing

HubSpot is renowned for its comprehensive CRM and inbound marketing software. HubSpot Email Marketing, in particular, stands out due to its impressive deliverability and seamless integration with other HubSpot products. Whether I’m running large-scale campaigns or personalized outreach, HubSpot’s email marketing tool offers the versatility and reliability I need.

Key Features of HubSpot Email Marketing:

- Up to 2,000 email sends per month on the free plan

- Integrated contact lists

- Drag-and-drop email builder

- Pre-designed templates

| Plan | Email Sends | Cost |

|---|---|---|

| Free Plan | Up to 2,000 per month | $0 |

| Paid Plans | Based on needs | Varies |

Using HubSpot allows me to efficiently manage my email outreach efforts and integrate them with other marketing activities. Explore more about finance content marketing to optimize your email strategies.

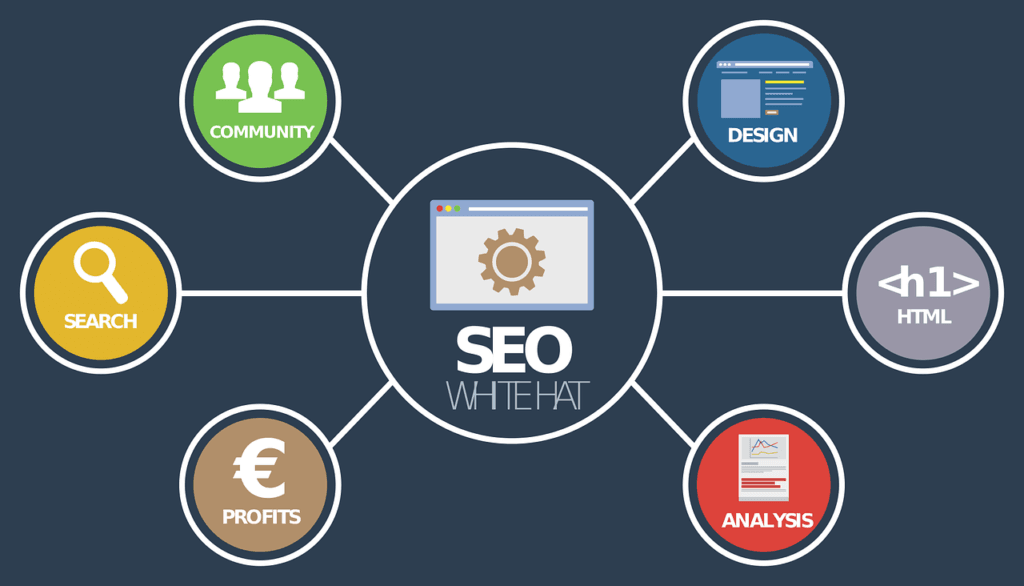

Ahrefs for Competitive Analysis

When it comes to competitive analysis and SEO optimization, Ahrefs is my go-to tool. It enables me to delve into competitor content, identify high-performing keywords, and understand backlink profiles. This insight is invaluable for crafting content that ranks well on search engines and drives organic traffic to my finance website.

Key Features of Ahrefs:

- Site Explorer for organic keyword analysis

- Backlink checker

- Competitor traffic estimation

- Content performance tracking

| Feature | Benefits |

|---|---|

| Site Explorer | Discover competitor keywords |

| Backlink Checker | Identify quality backlinks |

| Traffic Estimation | Gauge competitor success |

| Content Tracking | Optimize your own content |

Leverage tools like Ahrefs to stay ahead in the competitive landscape. For more strategies, visit our page on finance lead generation.

Unbounce for Landing Page Creation

Unbounce is essential for quickly creating and optimizing landing pages, a critical component of any digital marketing campaign. With Unbounce, I can easily build, tweak, and publish landing pages that are designed to convert visitors into leads. The tool also offers A/B testing and in-depth analytics to determine which elements perform the best.

Key Features of Unbounce:

- Drag-and-drop landing page builder

- A/B testing

- Analytical insights

- Conversion rate optimization

| Feature | Benefits |

|---|---|

| Drag-and-Drop Builder | Simplifies page creation |

| A/B Testing | Optimize page elements |

| Analytics | Measure and improve performance |

Creating effective landing pages is crucial for capturing leads and driving conversions. Unbounce is an invaluable tool in my digital marketing toolkit. Learn more about building impactful campaigns at finance marketing strategies.

By leveraging these tools, I can enhance my digital marketing efforts and achieve better results for my financial business.

Successful Marketing Campaigns

Exploring some of the most successful marketing campaigns provides valuable insights into the strategies and tools that can be employed in the realm of financial marketing. Here are some iconic campaigns that have set benchmarks for effective marketing.

Nike’s “Just Do It” Campaign

Nike’s “Just Do It” campaign, launched in 1988, is a classic example of connecting emotionally with the audience. The campaign focused on motivation and inspiration by sharing compelling stories that resonated deeply with people. Through this strategy, Nike managed to create thousands of personal story submissions, establishing a strong emotional bond with its audience (St. Bonaventure University Online).

Pepsi’s “Is Pepsi OK?” Campaign

Pepsi’s “Is Pepsi OK?” campaign debuted during Super Bowl LIII and cleverly tapped into real-life scenarios where customers often ask if Pepsi is an acceptable alternative to their first choice, Coca-Cola. This self-aware marketing approach resonated with viewers and contributed to a highly positive commercial message (St. Bonaventure University Online). This kind of market strategy is instrumental in financial services marketing to address and leverage consumer perceptions.

California Milk Processor Board’s “Got Milk?” Campaign

Launched in 1993, the California Milk Processor Board’s “Got Milk?” campaign is renowned for using effective consumer research, straightforward copywriting, and influencer marketing. By featuring Hollywood stars and celebrities with distinctive milk mustaches, the campaign became highly visible and impactful. The simplicity and directness of the slogan made it one of the most recognizable advertising campaigns (St. Bonaventure University Online).

Dove’s “Real Beauty” Campaign

Dove’s “Real Beauty” campaign, initiated in 2004 by Unilever, focused on empowering women and children by promoting diverse body types and challenging conventional beauty standards. The campaign’s mission was to make beauty a source of confidence rather than anxiety, effectively aligning with Dove’s brand values. This approach fostered a deeper connection with their audience and encouraged self-confidence (St. Bonaventure University Online). For more on strategies like these, refer to our articles on finance influencer marketing and digital finance marketing.

Old Spice’s “The Man Your Man Can Smell Like” Campaign

Old Spice’s “The Man Your Man Can Smell Like” campaign utilized humor to reposition the brand in the male grooming market. Featuring the “Old Spice Man,” the ad was both memorable and humorous, enhancing brand relatability and consumer identity. This campaign demonstrated the power of humor and identity in marketing (St. Bonaventure University Online).

| Campaign | Launch Year | Key Strategy | Outcome |

|---|---|---|---|

| Nike’s “Just Do It” | 1988 | Emotional connection | Increased brand loyalty |

| Pepsi’s “Is Pepsi OK?” | 2019 | Self-aware marketing | Positive brand perception |

| “Got Milk?” | 1993 | Influencer marketing | High campaign visibility |

| Dove’s “Real Beauty” | 2004 | Diversity and empowerment | Strong emotional bond |

| Old Spice’s “The Man Your Man Can Smell Like” | 2010 | Humor and identity | Brand repositioning |

For more on leveraging these strategies in the financial sector, visit our guides on financial services marketing and finance content marketing.

Business Intelligence in Marketing

Harnessing business intelligence tools is essential for growth in financial marketing. I rely on several tools to extract valuable insights that drive my strategies and campaigns effectively.

Utilizing Website Analytic Tools

Website analytic tools like Google Analytics offer invaluable data on website traffic sources, including which channels drive the most visitors. Understanding visitor behavior helps me optimize strategies for better conversions. I also track key metrics such as bounce rate, average session duration, and pages per session.

| Metric | Importance |

|---|---|

| Bounce Rate | Measures visitor retention |

| Average Session Duration | Indicates engagement level |

| Pages per Session | Reflects user interest |

For a comprehensive guide on using website analytics, check out our article on finance marketing strategies.

Harnessing Social Media Management Tools

Social media management tools enable me to create engaging content, share relevant information, and interact with potential customers. Tools like Sprout Social help me schedule posts, monitor social interactions, and analyze social media performance.

Benefits of Social Media Management Tools:

- Scheduling posts in advance

- Tracking engagement metrics

- Managing multiple accounts from one platform

To learn more about integrating social media into your strategy, visit our page on finance content marketing.

Enhancing Engagement with Video Marketing

Video marketing significantly enhances engagement levels, as viewers tend to interact more with videos than with written content. Platforms like YouTube allow me to create ‘how-to’ videos and educational content that attract potential customers.

| Platform | Type of Content | Engagement Level |

|---|---|---|

| YouTube | How-to Videos | High |

| Vimeo | Tutorials, Webinars | Moderate |

| TikTok | Short, Viral Content | Extreme |

For tips on creating impactful video content, explore our section on digital finance marketing.

Leveraging Email Marketing Tools

Email marketing tools such as Mailchimp assist in designing visually appealing emails, analyzing open rates, and understanding content performance. This helps me target my desired consumer audience more effectively.

Features of Email Marketing Tools:

- Customizable templates

- Detailed analytics on open and click rates

- Segmentation options for targeted campaigns

For actionable advice on email marketing, check our guide on finance lead generation.

By integrating these financial marketing tools, I can track performance metrics, engage my audience effectively, and refine my marketing strategies for the best results. Expanding your toolbox with these resources ensures that you’re leveraging the full potential of business intelligence for your marketing efforts. For more insights, visit our articles on finance industry marketing and finance influencer marketing.

Metrics for Financial Marketing Effectiveness

Marketing in the financial sector requires careful measurement of success using specific metrics. Here, I will discuss three critical metrics that have helped me evaluate and optimize my marketing efforts: Customer Acquisition Cost (CAC), Customer Lifetime Value (CLTV), and Return on Investment (ROI).

Customer Acquisition Cost (CAC)

Customer Acquisition Cost, or CAC, is a crucial metric for gauging the efficiency of your marketing strategies. It measures the cost of acquiring a new customer and involves calculating all related expenses such as advertising, marketing salaries, and sales efforts. By understanding CAC, I’ve been able to optimize my marketing budget and focus on the most cost-effective channels.

Formula for CAC:

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

Here’s a simple table to illustrate how CAC can vary:

| Month | Marketing Spend ($) | New Customers Acquired | CAC ($) |

|---|---|---|---|

| January | 10,000 | 50 | 200 |

| February | 12,000 | 60 | 200 |

| March | 15,000 | 70 | 214 |

Refer to Adverity for further insights into optimizing CAC for your financial services marketing.

Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) is essential for understanding the long-term value a customer brings to your business. This metric helps in formulating retention strategies and tailoring services to encourage higher spending and longer retention periods. By tracking CLTV, I’ve been able to develop more effective customer retention initiatives.

Formula for CLTV:

CLTV = Average Purchase Value x Purchase Frequency x Customer Lifespan

An example table for CLTV calculations:

| Customer | Average Purchase Value ($) | Purchase Frequency (per year) | Customer Lifespan (years) | CLTV ($) |

|---|---|---|---|---|

| Customer A | 500 | 2 | 5 | 5,000 |

| Customer B | 300 | 3 | 4 | 3,600 |

| Customer C | 700 | 1 | 6 | 4,200 |

Learn more on how CLTV influences finance marketing strategies at Adverity.

Return on Investment (ROI)

Return on Investment (ROI) is one of the most important metrics for measuring the effectiveness of your marketing investments. By calculating ROI, I can determine which campaigns deliver the best returns and allocate budgets to high-ROI strategies.

Formula for ROI:

ROI = (Revenue Generated - Total Costs) / Total Costs

A table to demonstrate different ROI values:

| Campaign | Revenue Generated ($) | Total Costs ($) | ROI (%) |

|---|---|---|---|

| Campaign A | 20,000 | 10,000 | 100% |

| Campaign B | 30,000 | 15,000 | 100% |

| Campaign C | 25,000 | 12,500 | 100% |

For more details on ROI and digital finance marketing, visit Adverity.

Effective financial marketing requires a deep understanding of these metrics. By constantly measuring CAC, CLTV, and ROI, financial marketers can optimize their strategies and achieve sustainable growth in the competitive financial landscape. Enhance your marketing approach today with data-driven insights and tools.